SECOND QUARTER 2024

Letter to Investors

July 16, 2024

My fellow investors,

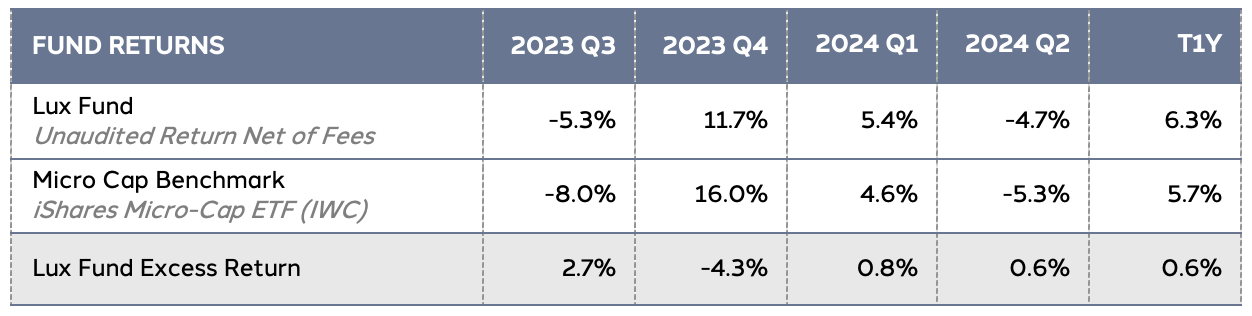

Lux Fund reached its one year anniversary, returning 6.3%ⁱ over the trailing year compared to the benchmark (iShares Microcap ETF) 5.7%. The fund achieved its goal of outperforming the benchmark net of fees in its inaugural year. This track record reaffirms that our strategy, designed to select the best long-term investment opportunities in the most overlooked segment of the stock market through a disciplined and diversified process, is working and also producing positive absolute returns for Lux Fund investors.

As we reflect on our progress since the fund’s launch, we are grateful to have attracted professionals who bring high-touch service, operational excellence and industry-leading investment expertise to our team. We are committed to meeting institutional quality standards and continue to invest in partnerships that best serve our investors. As a fully registered investment advisor in the state of Ohio, we have built an infrastructure capable of serving individuals, families and institutions who lack access to the historically highest-returning segment of the public equity market: micro cap equity.

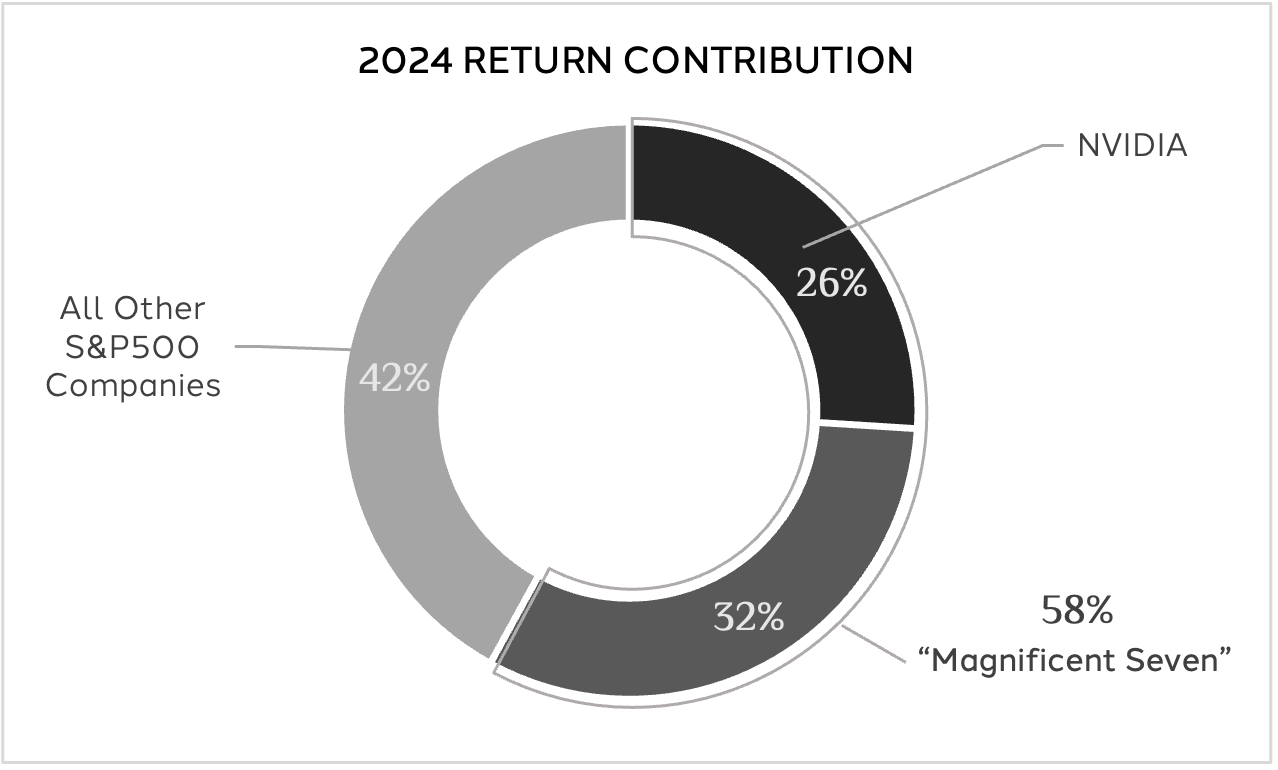

Financial headlines of late have rightfully focused on the “Magnificent Seven,” referring to the seven of the largest publicly traded companies (Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia and Tesla) which have driven a significant portion of S&P500 returns over the last two years. As a result, one third of every dollar invested in a S&P500 index fund today is a concentrated bet on these seven companies that have collectively appreciated 275% or $11.5T over the last five years. Today's passive large cap investments carry higher risks than in past years given increased concentration and valuation risks.

While the large cap equity asset class performance has outpaced the micro cap equity asset class in recent years, over the long-term, we expect micro cap to produce the highest returns in the stock market—as it has over the majority of historical market cycles—owing to its higher volatility profile and the required return to compensate. Lux Fund aims to outperform the micro cap asset class, given the structural inefficiencies present in this overlooked niche. We encourage investors to take advantage of the unique market environment by re-evaluating exposure to profitable micro cap companies which have been left behind in recent years (see page 2 for more details).

Gurnee Group was formed to create durable solutions for families and institutions. Lux Fund advances this purpose by democratizing access to a scarce corner of the market that few institutions allocate toward and to which families have virtually no exposure. It is a privilege to have your trust and we remain focused on stewardship of your investment. As we look forward to improving and growing this business, we seek new and better ways to serve you and welcome your feedback.

Thank you for your participation in Lux Fund and for trusting Gurnee Group.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

Given today's increasingly unique market environment, we believe Lux Fund holds an especially important and complementary place within investors’ total portfolio, providing downside protection relative to other equity investments.

-

Position Changes

New positions are initiated in the fund when they are attractive per Luxβeta™ and validated through Luxαlpha™. Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, or the company is acquired.

-

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

We believe actively managed micro cap equity is an important building block in the long term strategic asset allocation for high net worth and institutional investors given the structural inefficiencies of the asset class combined with its long term unique return and risk properties.

Given today's increasingly unique market environment, we believe Lux Fund holds an especially important and complementary place within investors’ total portfolio, providing downside protection relative to other equity investments.

The S&P500 has become unusually concentrated and reliant on companies with lofty valuations following a period of strong returns by the "Magnificent Seven". One stock, Nvidia, has accounted for ~25% of the S&P500 calendar returns year to date. Today, Nvidia is valued at 45x 2025 earnings, nearly double the S&P 500's average valuation over the last five years. This increases two risks to passive large cap investments: concentration risk and valuation risk.

CONCENTRATION RISK

Diversification reduces risk of loss and volatility potential which can dampen returns over time. Passive large cap investors are implicitly concentrating investments in seven companies which have been trading in tandem, fueled in part by optimism around capturing the economic benefits of artificial intelligence. These investors, which drive a significant share of high net worth and institutional capital, no longer enjoy the benefits of diversification.

VALUATION RISK

The top large cap companies have become expensive and must live up to their valuations to avoid the risk of a lost decade and generate future upside.

Consider Microsoft, the largest holding in the S&P500, comprising over 7% of the index. Microsoft's financials are the picture of "high quality" with $250B in annual sales, a high portion of which are recurring, 70% gross margins, and a pristine balance sheet. However, investing in any company requires the estimation of the company's future in combination with an evaluation of the price at which the investment is being made. Microsoft's market capitalization has increased around 225% or $2.4T over the last five years. We believe this increases the risk that new investments in Microsoft will experience a "lost decade" where an investment doesn’t produce a positive return for many years.

One need not look too far into the recent past to identify examples of lost decades. Investors in Cisco in 2000 at $54 have lost money to date (over the next 24 years), Cisco stock trading for $51 today. Year 2000 vintage investors in Microsoft faced a similar outcome, where Microsoft investors did not see a positive return for 17 years (2000-2017).

This is not an indictment on Cisco, Microsoft or large technology innovators. We do not pretend to have special knowledge of Microsoft's future prospects. However, investors should count on the invisible hand of capitalism: Microsoft's high returns on capital will invite new competition which will erode the company’s growth and profits, potentially eroding Microsoft's investment potential. Much like Cisco, companies operating in what appears to be a monopoly, for example, Nvidia's current perceived monopoly on artificial intelligence, valued at levels that suggest perpetual dominance, have the possibility of disappointing. Even if Nvidia's profits continue to grow, its stock could disappoint. Cisco delivered $2B in profits in 2000, growing to $12B in profits in 2023, and its stock is valued lower today than in 2000.

Valuing Nvidia at $3T implies high levels of certainty by investors of the company's long term dominance. We believe it is hard to forecast the future with certainty in the way this valuation portends. The following chart indicates the top five S&P500 companies at the beginning of each decade from 1980 to 2020. In 1980 and 1990 IBM stock was priced as if their supposed monopoly on the computer market would be durable in the long run, only to be usurped by many other companies over the ensuing decades. It seemed unfathomable that the price of oil could be negative (as it was during 2020) when Standard Oil, Schlumberger and Royal Dutch Petrol were among the largest companies in 1980 and 1990.

Given the combination of an uncertain future, valuations that portend certainty and increased concentration risk, we urge investors to consider diversifying away from recent investment winners and instead invest in ignored areas with strong fundamentals and reasonable valuations.

Similar to large cap companies with dominant market positions, many of Lux Fund’s investments are leaders in small markets. For example, Tactile Medical's leadership in lymphedema treatment equipment or Mitek Systems' near monopoly on mobile check deposit software. In contrast with large cap, however, these markets are smaller and less ripe for attracting additional capital eroding future profits. Ironically, we believe this backdrop creates a higher likelihood of long time durable investment opportunities.

Position Changes

-

New positions are initiated in the fund when they are attractive per Luxβeta™ (quantitative review) and validated through Luxαlpha™ (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

ARTERIS

ARQ

AUGMEDIX

DMC GLOBAL

EVOLUS

GENCOR INDUSTRIES

IDENTIV

LANTRONIX

MAXCYTE

MISTRAS GROUP

MATTERPORT

NEUROPACE

NORTHERN TECHNOLOGIES

QUICKLOGIC

ROCKWELL MEDICAL

SOUNDTHINKING

XERIS BIOPHARMA

ZOMEDIC

-

Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, or the company is acquired. The fund sold positions in the following companies during the quarter:

AMPLIFY ENERGY

CADRE

EVERSPIN TECHNOLOGIES

EVOLUTION PETROLEUM

HCI GROUP

IMMERSION

MANITOWOC

MATTERPORT (acquired)

ORGANOGENESIS

SEMLER SCIENTIFIC

SIGA TECHNOLOGIES

VISHAY PRECISION GROUP

FEATURED NEW POSITIONS

-

ARQ is an environmental technology company with roots in emission solutions and carbon applications. Investor sentiment around Arq has improved in recent years, however, we believe Arq stock is still inexpensively valued. We believe the company’s leadership in carbon products including granular activated carbon will enable large scale water filtration in municipal and commercial water treatment settings. Notably, granular activated carbon plays a unique role in water remediation from PFAS (forever chemicals). PFAS remediation represents a significant challenge and meaningful economic opportunity. In 2023, 3M agreed to provide $10B to public water suppliers to support PFAS remediation. In 2024, the EPA finalized a national water drinking water regulation establishing legally enforceable maximum containment levels for PFAS. We believe Arq will be a critical partner to public water systems in reducing PFAS contamination levels. New management has refocused the company to capitalize on the large opportunity over the next several years.

-

ARQ

-

GENCOR INDUSTRIES is a leader in the road and highway construction industry, participating across the roadway construction continuum manufacturing asphalt plants, providing asphalt mixing and thermal fluid process equipment and providing road paving machinery. Gencor’s fundamentals and investor sentiment are improving. We believe the Infrastructure Investment and Jobs Act will stimulate significant demand for the company’s equipment. The price of Gencor’s input costs, primarily steel, has eased, driving higher profitability. We believe the company is unknown to institutional investors given zero wall street firms formally report on the company and its shares are held largely by retail investors. Gencor has an immaculate balance sheet and our investment is well aligned with the company’s management team who owns over 30% of the company’s shares.

-

Gencor Industries

-

NEUROPACE invented neurostimulation technology that reduces seizures for patients ailing from drug resistant focal epilepsy. NeuroPace’s implantable device monitors brainwaves, detects seizure related activity, and responds in real time by sending disruptive pulses. This technology offers a less invasive alternative to removing patient brain tissue. NeuroPace is formally studying its technology in treatment of generalized epilepsy patients, which would enable the company to offer treatment to more patients. We believe the business’s disruptive technology may illuminate strategic value to other large long standing medical technology equipment businesses providing decades old epilepsy therapies.

-

Neuropace

-

ROCKWELL MEDICAL is the second largest US provider of dialysis treatment supplies known as hemodialysis concentrates. Rockwell has taken significant measures to improve its business model and outlook since the 2022 appointment of CEO Mark Strobeck. In late 2022, Rockwell terminated an exclusive licensing agreement with Baxter. This ill-fated 10 year agreement signed in 2014 prohibited Rockwell from achieving profitability through the agreement’s termination. In 2023, Rockwell consolidated market share by acquiring Evoqua, the third largest US provider of hemodialysis concentrates. Later in 2023, Rockwell expanded its partnership with its largest customer, DaVita, improving Rockwell’s economics and visibility. We believe these actions in combination increase the likelihood of Rockwell generating consistent profits in an oligopoly market providing essential medical supplies. While these business model improvements have gone largely unnoticed by investors, we believe continued execution will lead to broader recognition and a significantly higher valuation for the shares.

-

Rockwell Medical

Performance Summary

Returns

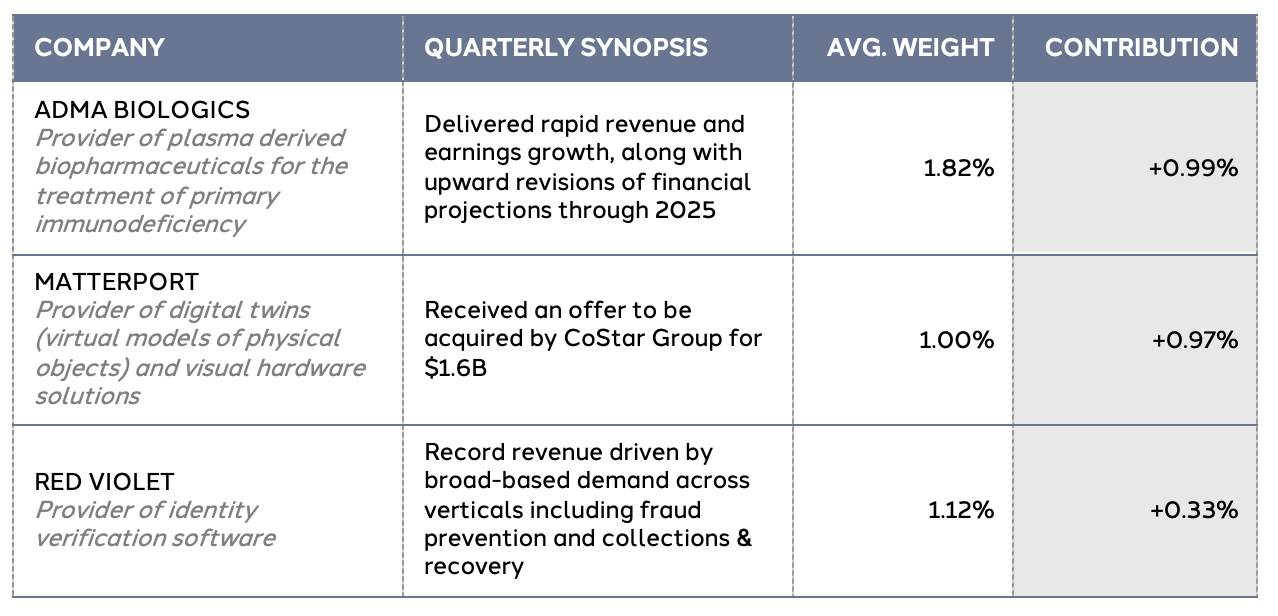

Top Contributors

Top Detractors

Portfolio Characteristics

Top 10 Holdings

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.