THIRD QUARTER 2024

Letter to Investors

October 30, 2024

My fellow investors,

During the third quarter of 2024, Lux Fund returned 10.6%ⁱ, outperforming the benchmark (iShares Microcap ETF) 8.3%. The Fund also outperformed the S&P 500's return of 5.9%.

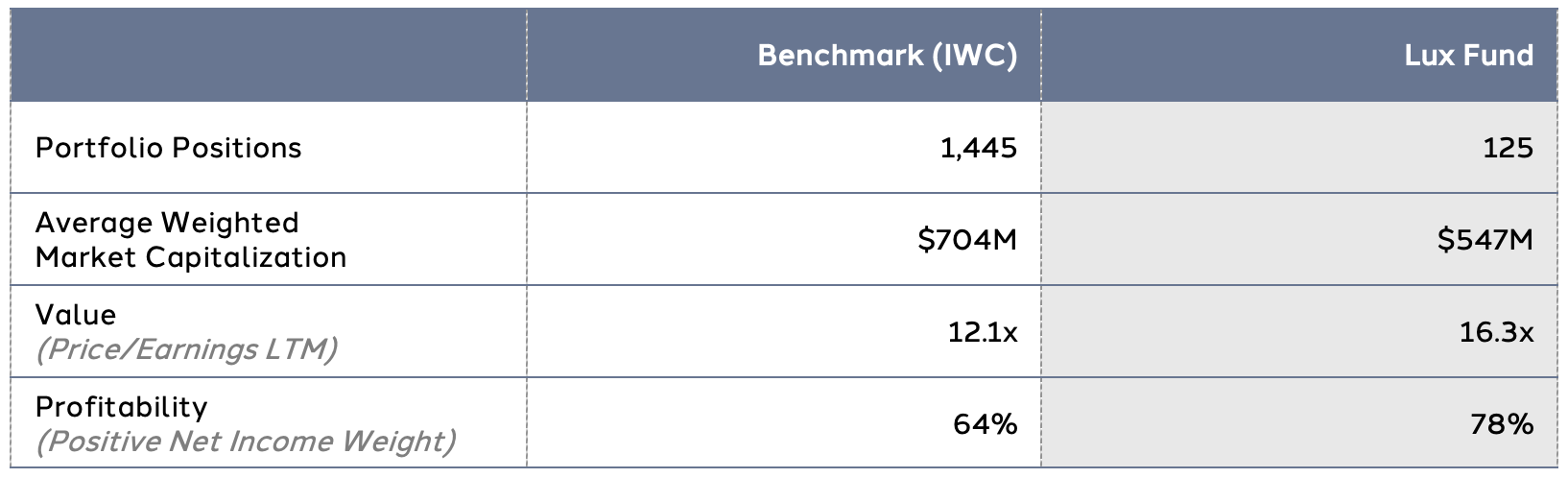

Micro cap stocks appreciated 12% in the month of July compared to large cap’s modest gains of 1%. This strong performance followed July's Consumer Price Index report which indicated decelerating inflation. Lux Fund participated in the appreciation, while insulating against modest declines faced by the rest of the market in August and September. Through quantitative analysis, we are able to avoid the low-quality companies which make up about 40% of the micro cap asset class. Low-quality companies typically perform relatively worse in a declining market.

We believe the third quarter's results highlight the disconnect between valuations of large cap and micro cap equities. Following July's micro cap outperformance, The Wall Street Journal published an article indicating large cap stocks have never returned more than 5% annually over the 10 years subsequent to when they are valued at today’s prices.

Lux Fund's core micro cap investments trade at a significant discount to large cap public equities despite similar profit margins and balance sheet strength. Historically, the discount has preceded the micro cap asset class’ outperformance over large cap, and we expect history to repeat itself. Regardless of the shift’s precise timing—or if a reversion occurs at all—we have confidence that the portfolio's underlying quality will continue to drive our results (please see Portfolio Outlook for more details).

We are finalizing Lux Fund's transition of custody services to U.S. Bank, ensuring the security of our fund's growing assets. It is a compliment to our organization that continuously more families and institutions trust us and see the value that Lux Fund brings to their overall portfolio. Additionally, many of our initial investors have decided to increase their investment allocation to constitute a more appropriate portion of their liquid investments. If you would like to discuss the most effective use of Lux Fund in your wealth strategy, please reach out—we are happy to help.

Thank you for your participation in Lux Fund and for trusting Gurnee Group.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

Our core holdings have the ability to compound profits driving stock appreciation, even in the absence of the valuation dislocation reversing.

-

Position Changes

New positions are initiated in the fund when they are attractive per Luxβeta™ and validated through Luxαlpha™. Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, or the company is acquired.

-

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

Nobel Prize winning research developed at the University of Chicago supports and inspires Lux Fund's investment approach.

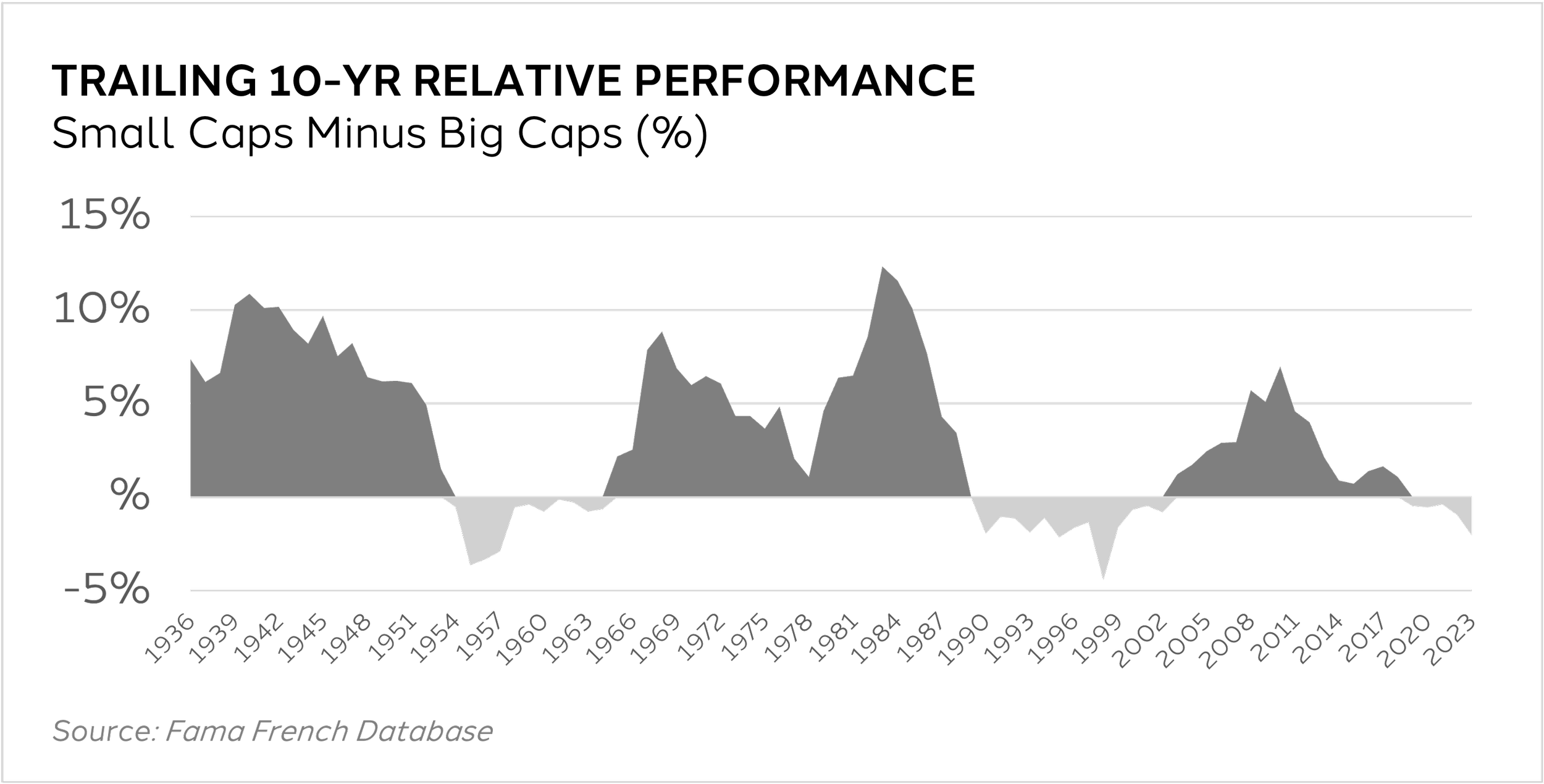

Small stocks outperform large stocks.

Periods of small cap underperformance have been followed by prolonged periods of outperformance over the last 85+ years. We believe the recent period of small cap underperformance creates an opportunity for investors to benefit from a reversion to normal over the next few years. We believe the opportunity in micro cap, as a stronger extension of small cap, to be an even greater opportunity to benefit from a reversion.

Two current dynamics may adversely impact a passive index fund investment approach to the micro cap market:

1 Proliferation of unprofitable companies

We believe using an active approach to investing in micro cap equity is the best way to address this dynamic. Forty cents on a dollar invested passively in micro cap index funds is exposed to unprofitable companies. Lux Fund's approach systematically avoids unprofitable companies, while seeking out the best companies in the asset class.

2 Increased role of private equity slowing the growth of publicly listed companies

Despite the increase in private equity-backed companies over the last 15 years, there are still 2,000+ micro cap companies, many of which are leaders in their particular niche. Our investment process scours this rich opportunity set of businesses in search of the highest quality leading companies. On average, our investment team meets with 75 management teams per quarter to find the best opportunities. The product of our efforts to locate and invest in high quality leading companies is reflected in Lux Fund’s core investments (80% of the portfolio) which have a return on equity (profitability) profile in line with the S&P 500.

Further, 25% of Lux Fund’s holdings are invested in companies that hold a number one, two, or three leadership position in their respective industry (see sample of core investments listed below).

As a result of our investment process, we believe our companies have the ability to appreciate even in the absence of the valuation dislocation reversing.

Our portfolio of profitable companies trading at significant discounts will continue to grow in their respective markets and will continue to be attractive acquisition targets to large companies looking to acquire leadership positions in tangential markets.

Position Changes

-

New positions are initiated in the fund when they are attractive per Luxβeta™ (quantitative review) and validated through Luxαlpha™ (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

BLADE AIR MOBILITY

COMMUNITY TRUST BANCORP

FENNEC PHARMACEUTICALS

FLOTEK INDUSTRIES

LENSAR

LOGILITY SUPPLY CHAIN SOLUTIONS

MID PENN BANCORP

M-TRON INDUSTRIES

NATHAN’S FAMOUS

NORTHWEST PIPE COMPANY

OLO

SPARTANNASH

VOYAGER THERAPEUTICS

-

Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

AUGMEDIX (acquired)

BEL FUSE

BRILLIANT EARTH GROUP

EAGLE PHARMACEUTICALS

HAWKINS

INFORMATION SERVICES GROUP

ITERIS (acquired)

LOVESAC COMPANY

NVE CORPORATION

TRANSCAT

ZYNEX

FEATURED NEW POSITIONS

-

LOGILITY SUPPLY CHAIN SOLUTIONS provides proactive supply chain planning software to 650 enterprise clients across a variety of industries. The company has been consistently profitable for the past 22 years driven by software subscriptions which comprise the majority of earnings. Stable cash accumulation has enabled the company's pristine balance sheet which today holds significant cash and zero outstanding debt. Unfortunately, Logility's results have stagnated over the last ten years, underperforming peer software providers which have grown significantly. We believe poor corporate governance, specifically, a dual shareholder structure concentrating company control to a single Class B shareholder, has prohibited the company from realizing its full potential. However, the Fund's investment is motivated by a pattern of positive developments which suggest potential for shareholder value to be realized through either fundamental business improvement or the sale of the company to a strategic or financial acquiror. The company's Executive Chairman (and single Class B shareholder) announced his resignation in February and an agreement was reached to eliminate Class B shares in April. These actions collectively chart a path for transferring the company's control to aligned shareholders. In June, Jim Miller, the company's new Chairman of the Board purchased ~$2,500,000 of company stock on the open market. This is especially noteworthy: In 22 years as a board member, Miller sold shares 12 times and has never purchased shares (until June). We believe the company's underlying value will be realized and our investment has strong downside protection given the company’s balance sheet and consistent profitability.

-

Logility Supply Chain Solutions

-

NATHAN’S FAMOUS is a leader in the hot dog industry having built arguably the most iconic hot dog brand over the last 100 years with products currently sold in over 70,000 locations globally. The company wisely capitalized on its strong brand, pivoting the business from its heritage in operating low margin hot dog stands to profitable retailing, wholesaling and licensing of Nathan’s Famous Hot Dogs and related products. Nathan's is one of the most resilient companies in the entire economy: Nathan's profitability was impacted less than 10% through the two largest economic shocks of the last 20 years (2007-2009 and 2019-2021) while also generating free cash flow every year of the last 25. Less than 10% of S&P 500 companies can match that claim, and these companies are valued at 35x free cash flow on average. Lux Fund’s investment in Nathan’s Famous was made at more than a 50% discount to that valuation, with the business’ current valuation significantly underestimating the company’s durability. Our investment is aligned with the company’s management and board given their 30% combined ownership in the business.

-

Nathan’s Famous

-

OLO enables restaurant chain consumers to order takeout and delivery online. The company’s industry leading software is used in 82,000 restaurants across 700 brands including Chipotle, Five Guys and P.F. Chang's. The company has grown significantly over the last five years by displacing inconvenient software that was internally developed by restaurants. The business benefits from a strong network effect (customer payment information uploaded once can be applied across all Olo's participating restaurants) and high switching costs given restaurants’ high need for continuity in online orders. Multi-year subscription contracts comprise the majority of Olo’s earnings affording the company predictable results. The company is profitable and has over $300M of cash on its balance sheet.

-

Olo

Performance Summary

Returns

Top Contributors

Top Detractors

Portfolio Characteristics

Top 10 Holdings

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.