FOURTH QUARTER 2024

Letter to Investors

January 30, 2025

My fellow investors,

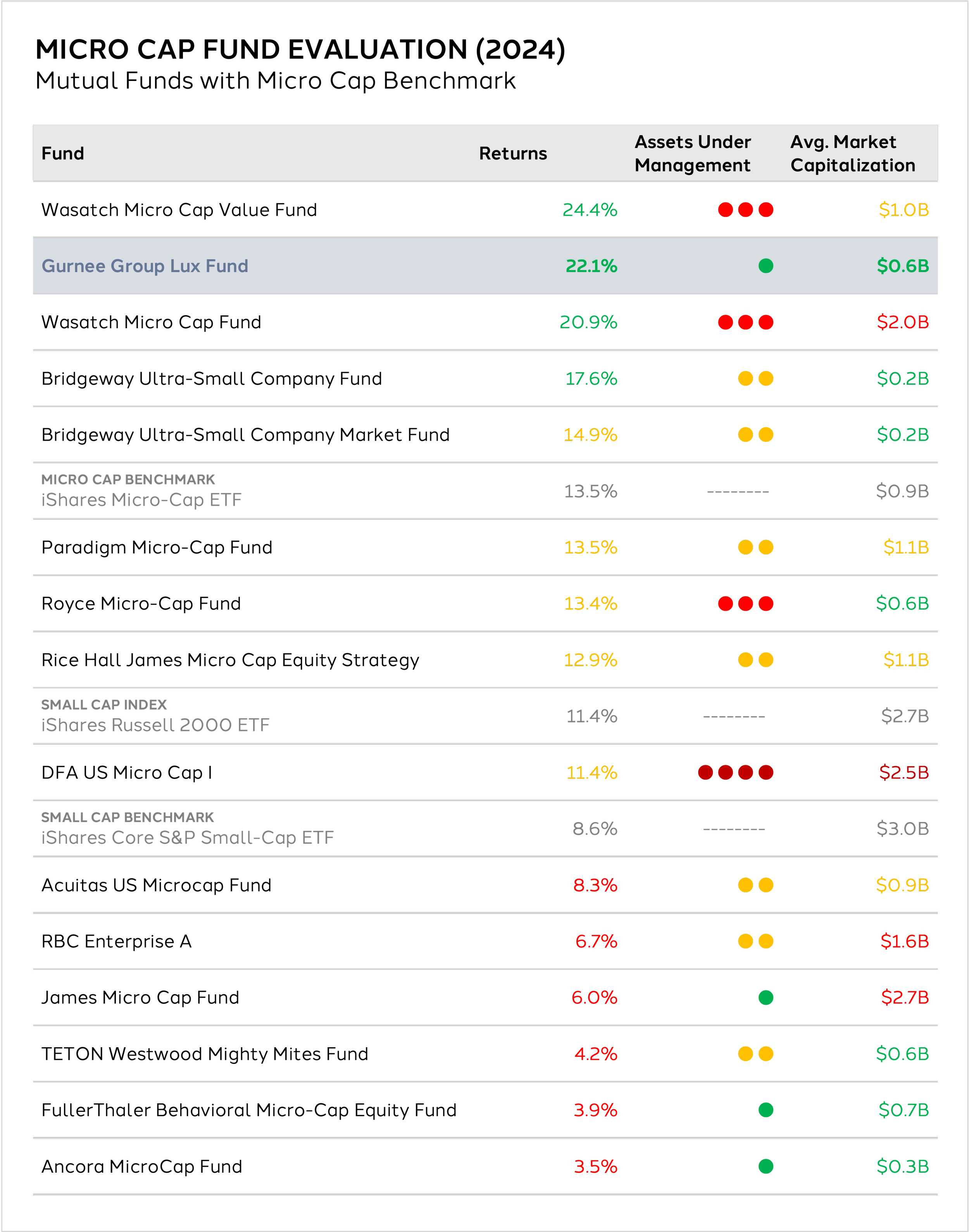

Lux Fund completed a successful 2024 returning 9.9%ⁱ for the fourth quarter, outperforming the benchmark’s (iShares Microcap ETF) 5.8% return and the S&P 500's 2.4% return. For the full year 2024, the Fund earned returns of 22.1% compared to the benchmark’s return of 13.5%.

The combination of our proprietary investment process (drawing on complementary qualitative and quantitative research disciplines) and unique investment universe (focused on companies with less than $1B in market capitalization) differentiate the strategy from the 5,900 US equity mutual funds active today. This distinct method enabled the Fund to provide strong returns in 2024, outperforming 13 out of the 14 actively managed micro cap mutual funds we monitor and 95% of the 565 small blend mutual funds in the Morningstar database. These results illuminate the potential in applying an investment process developed over 20 years to a group of companies neglected by institutional investors.

Many investors use Lux Fund as a tool to gain exposure to the smallest companies in the market, diversifying from S&P 500 companies already strongly represented in their investment portfolio. Unlike the S&P 500, where seven companies operating in the technology sector were responsible for nearly half of the year's return, a broad set of companies operating across independent niche industries drove Lux Fund's return for 2024. We favor broad return profiles driven by many companies in uncorrelated industries relative to narrow return profiles driven by a few companies in a single industry.

Consistent with recent quarters, Lux Fund's core investments continue to trade at a significant discount to large cap public equities despite profitability and balance sheet metrics on par with large company counterparts. The current valuation discount reflects the trailing 10 years' unusual underperformance of micro cap assets compared to large cap assets.

In 2024, Gurnee Group made significant investments to professionalize Lux Fund in anticipation of onboarding institutional clients in 2025. While the Fund's assets under management continue to grow, the Fund remains open to new investors and additional contributions.

Our optimism for further success stems from our repeatable approach to identify investment opportunities in the micro cap investment universe amplified by the potential for a rebound in the asset class' return profile towards superior historic norms.

Thank you for your participation in Lux Fund and for trusting Gurnee Group.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

Though there is scarcity in micro cap funds across the industry, Lux Fund is committed to prudent allocation of our capacity and confident in our strength as a long-term investment solution.

-

Position Changes

New positions are initiated in the fund when they are attractive per Luxβeta™ and validated through Luxαlpha™. Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, or the company is acquired.

-

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

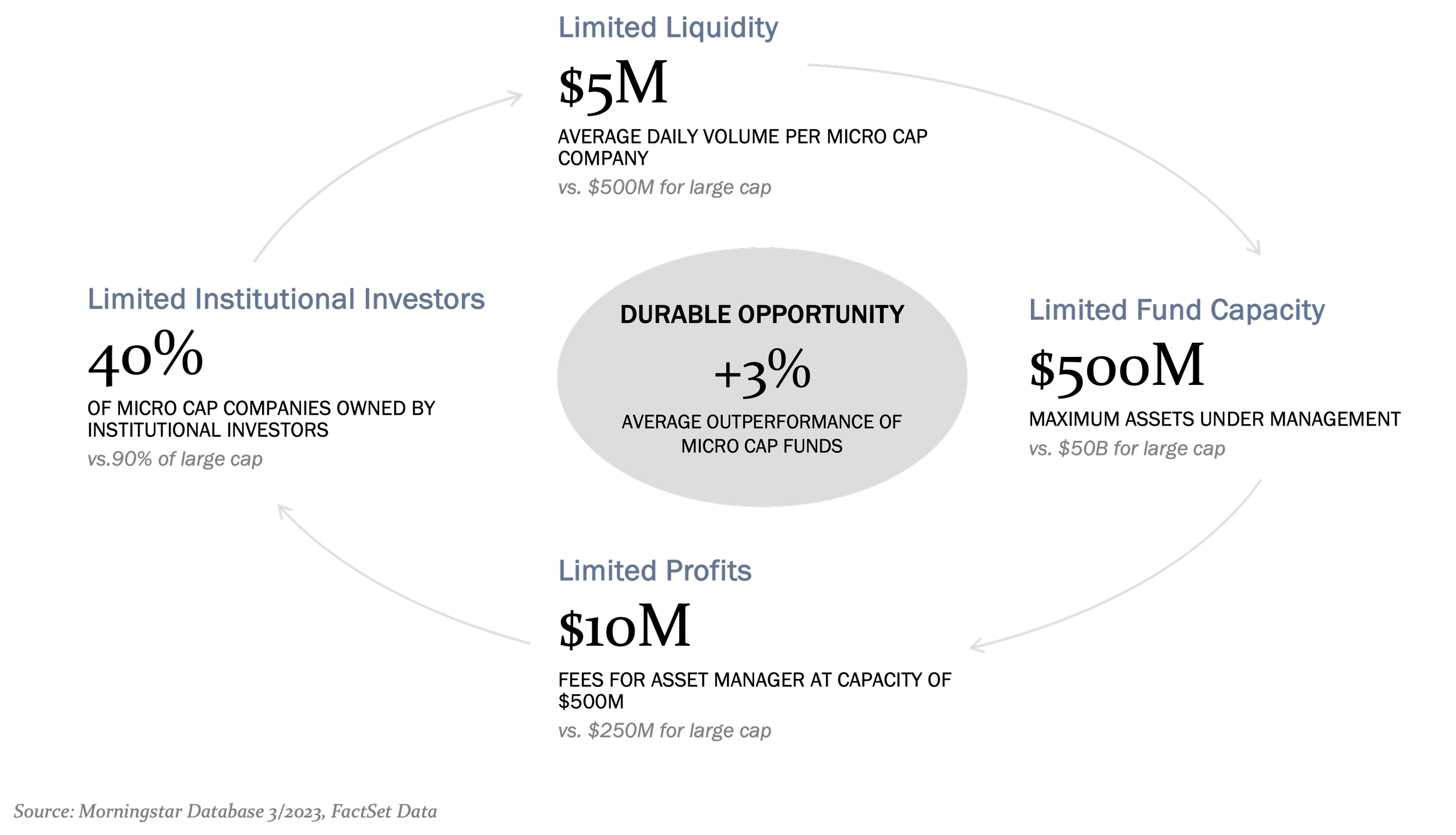

Gurnee Group launched Lux Fund two years ago to provide a solution for families and institutions who have been underserved by the financial services industry due to structural disincentives.

Despite the micro cap asset class providing the highest long term returns of any public equity asset class and one of the only opportunities to generate consistent excess returns through active portfolio management, structural economic disincentives deter large investment firms from delivering this valuable product to their clients. Due to the limited-liquidity nature of the micro cap asset class, the amount of assets a firm can manage in micro cap funds is a fraction of large cap, resulting in lower profits for micro cap managers, and therefore, most asset managers do not invest in this space. As a result, most people and organizations miss out on this lucrative piece of a holistic portfolio.

For the few micro cap options that do exist, we use three key performance indicators when evaluating their quality and durability:

1 Returns

Investors entrust their savings to a micro cap fund with the expectations of being rewarded for the higher amount of risk assumed in these small companies, and select active managers for their ability to identify outperforming companies. As the micro cap category is less efficient compared to the rest of the stock market, active managers experience more success in this area. While we expect some year-to-year volatility, strong returns relative to the passive alternative (iShares Micro-Cap ETF) over the long-run are required.

2 Assets Under Management

As micro cap funds grow assets, their ability to invest in the smallest companies declines. We monitor a fund’s assets under management (combined with their number of holdings) in order to gauge their propensity to benefit from opportunities in the market’s smallest companies.

3 Average Market Capitalization

Many micro cap funds start out disciplined, investing in companies that are indeed micro caps (market capitalization threshold under $1B). As assets under management grow, managers are tempted to allow their fund size to swell to generate additional fees. This allows firms to maximize profits, but it limits a manager’s ability to buy and benefit from true micro cap stocks. Maintaining a low average market capitalization serves as a signal of style purity in our assessment.

Though there is scarcity in micro cap funds across the industry—both as a result of few funds and full funds—Lux Fund is committed to prudent allocation of our capacity and confident in our strength as a long-term investment solution.

Position Changes

-

New positions are initiated in the fund when they are attractive per Luxβeta™ (quantitative review) and validated through Luxαlpha™ (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

ARDELYX

ALDEYRA THERAPEUTICS

BACKBLAZE

EVENTBRITE

GAIA

LAKELAND INDUSTRIES

TURNING POINT BRANDS

-

Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

CARPARTS.COM

FORUM ENERGY TECHNOLOGIES

HERON THERAPEUTICS

INNOVID (acquired)

PUMA BIOTECHNOLOGY

FEATURED NEW POSITIONS

-

GAIA provides video streaming services to roughly one million global subscribers. The company’s streaming library includes documentaries and meditation programs in addition to the business' heritage in yoga practices. The Fund's investment in Gaia captures the advantages of the video streaming business model while avoiding its weaknesses. Like other streaming companies, Gaia benefits from profitable recurring revenue with high incremental margins. However, unlike others, Gaia is vertically integrated, owning its own studio and self-producing the majority of its broadcasted content. Uniquely, Gaia's cost per production hour is $35,000, while industry leading production costs range as high as $10,000,000+ per hour. Despite Gaia's extreme production cost advantage, Gaia's monthly subscription fee is equivalent to competitor streaming services. The company recently implemented the first subscription price increase in company history with minimal subscriber attrition, demonstrating the value of Gaia's service while driving higher future profitability. Recently, company earnings have been suppressed by investments in a line of dietary supplements which will be marketed to Gaia's significant membership base. Recent developments indicate the supplements investment may become a tailwind to earnings, not a headwind, as early as 2025. We believe the Fund's investment was made at a significant discount to comparable business valuations given investor unawareness of the company. The Fund's investment is strongly aligned with the company's management and board of directors who collectively own more than 30% of the company's shares.

-

Gaia

-

LAKELAND INDUSTRIES is a leading provider of industrial and fire safety personal protective equipment (PPE). The company is strategically focused on building a leadership position in the fragmented fire safety PPE market following James Jenkins' recent appointment to CEO. Compared to the industrial PPE market, the fire safety PPE market experiences higher repeat sales and less cyclicality given the inevitability of fire emergencies and consistency in public safety customer purchasing patterns. The fire safety PPE market often requires accompanying decontamination (equipment cleaning) services, which, at scale, can be provided by Lakeland at attractive margins. CEO Jenkins has significant acquisition expertise drawing on his background as an executive at Transcat, a company which successfully consolidated the laboratory calibration services industry through a series of acquisitions over many years. Through small acquisitions of fire safety equipment companies, Lakeland is assembling a "head-to-toe" fire safety product offering consisting of helmets to jackets to boots which will enable cross selling opportunities and manufacturing savings opportunities. The Fund's investment in Lakeland was made at a significant discount to a larger publicly traded fire safety company, despite the opportunity for Lakeland to gain market share and scale over the coming years.

-

Lakeland Industries

-

TURNING POINT BRANDS provides tobacco related products including rolling papers, nicotine pouches and chewing tobacco. Turning Point Brands' market leading product portfolio including Zig-Zag and Stocker's Products collectively generate consistent cash flow enabling the company opportunities to further leverage its leadership through building adjacent products lines. The company's successful launch of FRE nicotine pouches and recently announced joint venture with Tucker Carlson Network to launch Alp nicotine pouches each represent significant growth opportunities and investment option value. The company's tobacco related product categories have historically provided inflation protection, which may prove valuable in a potential persistent inflationary economic environment. The Fund's investment is increasingly aligned with company insiders following the nomination and subsequent election of a significant shareholder to the company's board of directors.

-

Turning Point Brands

Performance Summary

Returns

Top Contributors

Top Detractors

Portfolio Characteristics

Top 10 Holdings

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.