FIRST QUARTER 2025

Letter to Investors

May 20, 2025

My fellow investors,

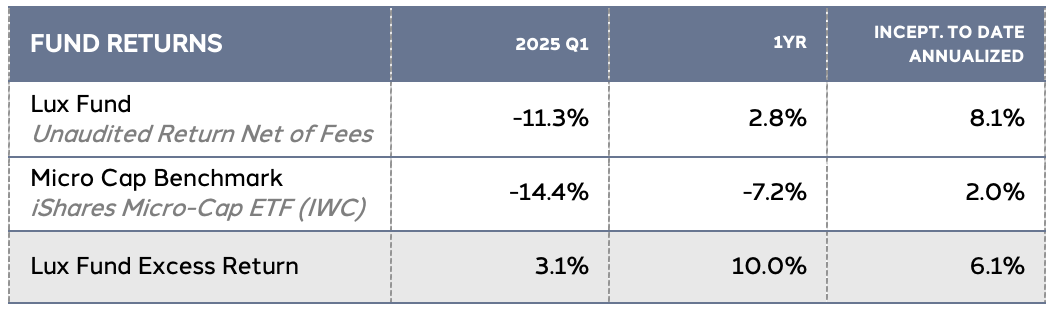

We designed Lux Fund to complement our investors’ portfolios by providing exposure to small, high-quality companies in a risk-controlled, diversified manner. The Fund's approach is unique, providing transparency and liquidity while pursuing returns in excess of the broader micro cap equity asset class. Since forming Gurnee Group in 2023, we have delivered upon our objective, returning a 6.1% annualized net excess return and, a 10.0% net excess return over the trailing twelve months.ⁱ

The stock market began the year with high volatility as global trade policy incited investor uncertainty. This period demonstrated Lux Fund’s resilience, supported by the underlying quality of its holdings, in which the Fund outperformed its benchmark (iShares Micro-Cap ETF, IWC) by 3.1%, returning -11.3%, versus the benchmark -14.4%. We seek to both protect your investment and grow it, and this quarter's result illustrates the value of our careful curation of Lux Fund.

We continually scour the micro cap equity asset class for healthy businesses trading at a discount to include in the Fund. The stock market declines in the first quarter, continuing into April, created significant investment opportunity. The micro cap equity asset class, broadly comprised of companies more sensitive to economic conditions and financing costs, faced a sharper price decline than its large cap equity counterpart.

Said simply, the continued global trade policy risk caused investors to, “throw the baby out with the bathwater.”

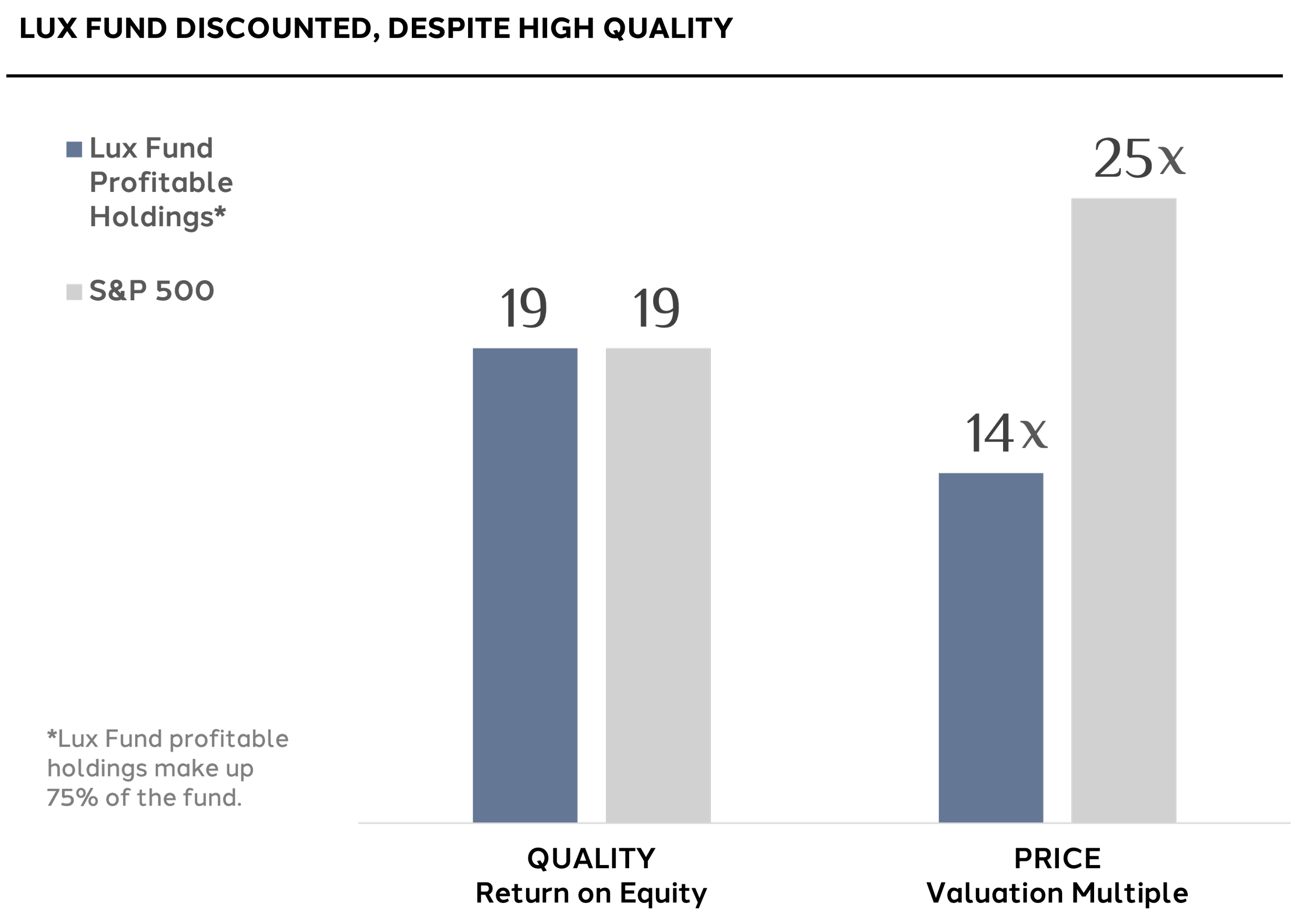

To illustrate the output of our investment process, we highlight Lux Fund’s quality—equal with the S&P 500—but trading at a 45% valuation discount. We unpack recent actions we took to benefit from select opportunities in this quarter’s report.

As we continue to build our investment organization we are pleased to announce Connor Stutz joined our team as an analyst this quarter. Connor has already made operational contributions to the firm and will expand our depth in service excellence. I am excited for you to meet him.

Thank you for your participation in Lux Fund and for trusting Gurnee Group.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

Our disciplined process led us to invest in a range of companies across industries such as defense, U.S.-based infrastructure, and healthcare services—businesses we believe were oversold amid broader market volatility in the first quarter.

-

Position Changes

New positions are initiated in the fund when they are attractive per Luxβeta™ and validated through Luxαlpha™. Positions are sold from the fund when their Luxβeta™ profile deteriorates, the company develops significant off model risk, or the company is acquired.

-

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

Uncertainty often creates compelling investment opportunities. Our team has successfully managed billions in institutional client assets through three of the most challenging market environments in recent history: the dot-com bubble, the global financial crisis, and the COVID-19 pandemic. In each instance, investor sentiment was dominated by the "risk of the moment." Today, sentiment is focused on global trade policy and its potential economic impact.

Throughout these market cycles, we’ve gained valuable insights and refined a disciplined framework that is equally effective in the ordinary course of market operations as it is at uncovering opportunities during times of heightened investor fear.

While the causes of each downturn differ, investor behavior often follows a familiar pattern—most notably, the indiscriminate selling of stocks, particularly in inefficient areas such as micro cap equity. These periods of dislocation can create attractive, long-term investment opportunities.

Leveraging this experience, we have focused on capitalizing on current market inefficiencies. As always, our investment approach combines two proprietary processes:

In applying our investment principles (including the assessment of business durability, identification of discounts to intrinsic value and investing with a margin of safety) we consider trade risk, US revenue exposure, balance sheet quality, profitability track record, and valuation.

This disciplined process has led us to recently invest in a range of companies across industries such as defense, U.S.-based infrastructure, and healthcare services—businesses we believe were oversold amid broader market volatility. These companies exhibit strong fundamentals and, in our view, are well-positioned over time regardless of the outcome of global trade policy. In each case, we have either added to existing positions or initiated new ones.

While we continuously monitor the portfolio’s health and outlook, we have identified the following opportunities for absolute return upside that the recent global trade policy uncertainty has created for our Fund:

Position Changes

-

New positions are initiated in the fund when they are attractive per LuxβetaTM (quantitative review) and validated through LuxαlphaTM (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

BIGCOMMERICE HOLDINGS

DAY ONE BIOPHARMACEUTICALS

DHI GROUP

ENERGY SERVICES OF AMERICA

HOME BANCORP

J. JILL

NATIONAL RESEARCH CORPORATION

TREACE MEDICAL CONCEPTS

-

Positions are sold from the fund when their LuxβetaTM profile deteriorates, the company develops significant off model, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

1-800-FLOWERS.COM

ANIKA THERAPEUTICS

ARIS WATER SOLUTIONS

DMC GLOBAL

LOGILITY SUPPLY CHAIN SOLUTIONS (acquired)

MOVADO GROUP

MYOMO

NERDWALLET

REPOSITRAK

SOLO BRANDS

VIMEO

FEATURED NEW POSITIONS

-

DAY ONE BIOPHARMACEUTICALS developed Ojemda, a targeted therapy for pediatric brain cancer. The company in-licensed an overlooked molecule, tovorafenib, from Takeda Pharmaceuticals in 2019 and rapidly advanced the agent through clinical development. The company's success represents one of the few pediatric cancer therapy breakthroughs in the history of medicine. Accordingly, Ojemda has enjoyed strong patient adoption since its FDA approval in early 2024. Day One has the opportunity to treat 2,000-3,000 patients annually with Ojemda and is conducting additional trials to expand the therapy's usage to earlier treatment settings. The company has a fortress balance sheet to fuel growth through profitability expected in 2027. Longer term, we expect the company to generate significant profitability given the relatively small group of elite academic treatment centers that care for the target patient population can be reached with a small salesforce. Further, we believe Day One may be an attractive acquisition target at current valuation levels as its stock is valued in a similar vein as unproven clinical stage biotechnology assets.

-

Day One Biopharmaceuticals

-

NATIONAL RESEARCH COPRORATION provides analytical services to healthcare providers throughout the United States. The company's data play a critical role in calculating healthcare provider reimbursement payments through value based care payment models, models which have steadily driven an increasing portion of Medicare and commercial insurance reimbursements over the last ten years. Few companies have capitalized on the shifting healthcare reimbursement scheme as well as National Research Corporation which has built a dominant market share servicing 75% of the largest 200 health systems in the US representing 10,000 facilities. Given the mission critical nature of the services to its customers, customers face high switching costs resulting strong retention on multi-year contracts for the company. Recently, company growth has slowed, enabling the Fund's investment to be made at a compelling valuation representing a ~50% valuation discount to Ares & Leonard Green's 2019 purchase price of competitor Press Ganey. We believe the company's recently announced CEO transition from the company's founder to an external healthcare services leader who formerly operated Amazon's health initiative has the potential to re-accelerate growth and unlock investment value. The Fund's investment interest is aligned with National Research Corporation's founder who continues to own ~45% of the company.

-

National Research Corporation

Performance Summary

Returns

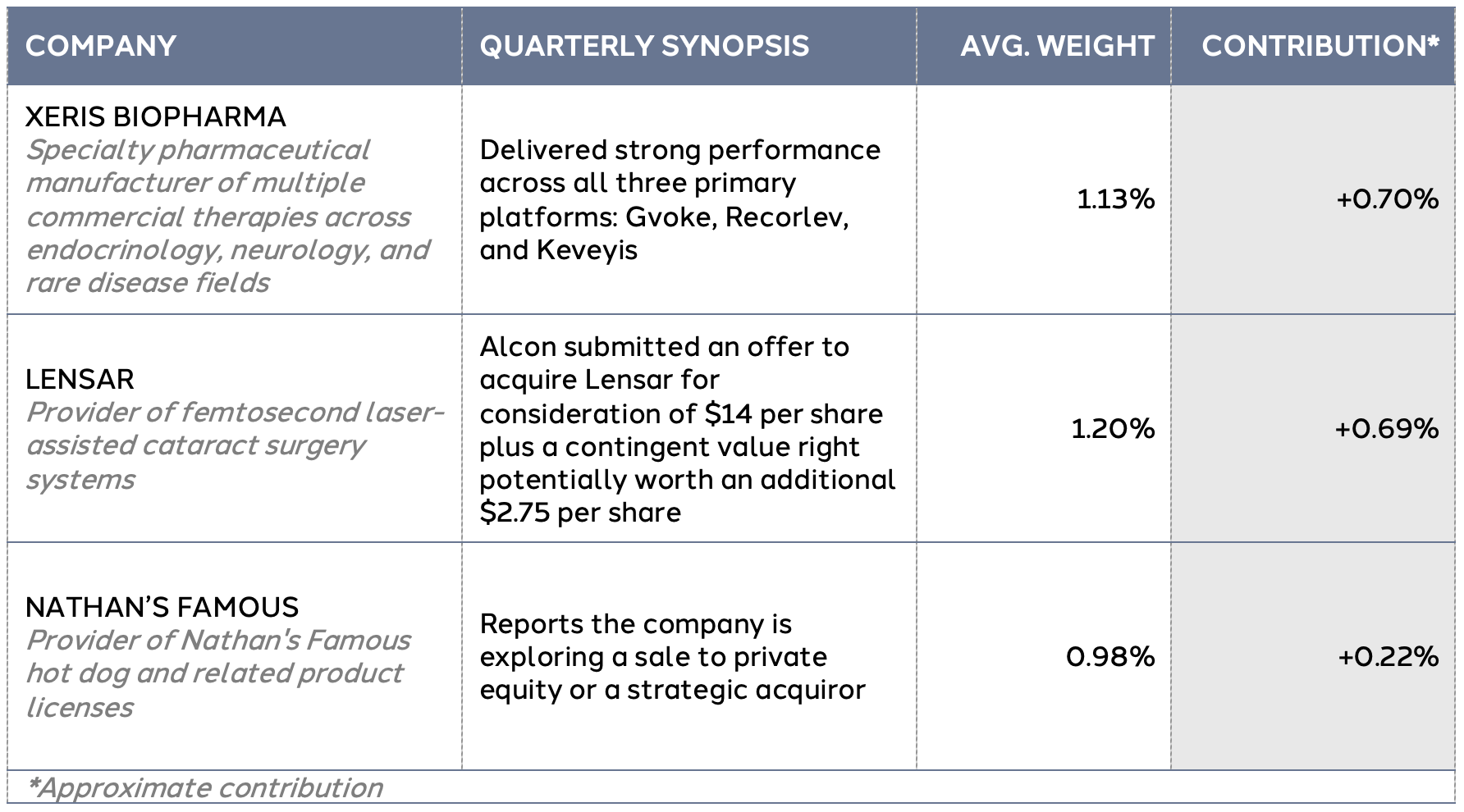

Top Contributors

Top Detractors

Portfolio Characteristics

Top 10 Holdings

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.