THIRD QUARTER 2025

Letter to Investors

November 12, 2025

My fellow investors,

Lux Fund produced strong returns during the third quarter of 2025, appreciating 15.2%. We recognize another quarter of growing investor capital through a disciplined, diversified strategy of investing in what we believe to be the highest quality companies within the most rewarding segment of public equities.

Third-quarter performance was supported by acquisition offers for four of our portfolio holdings. Since inception, 14 of our companies have been acquired at premiums to their market value—an encouraging validation of our strategy. We’re optimistic about the relative return potential of smaller public equities and the attractive opportunities in this under appreciated market segment.

Third-quarter performance was supported by acquisition offers for four of our portfolio holdings. Recall our investment theses for these featured companies from previous letters:

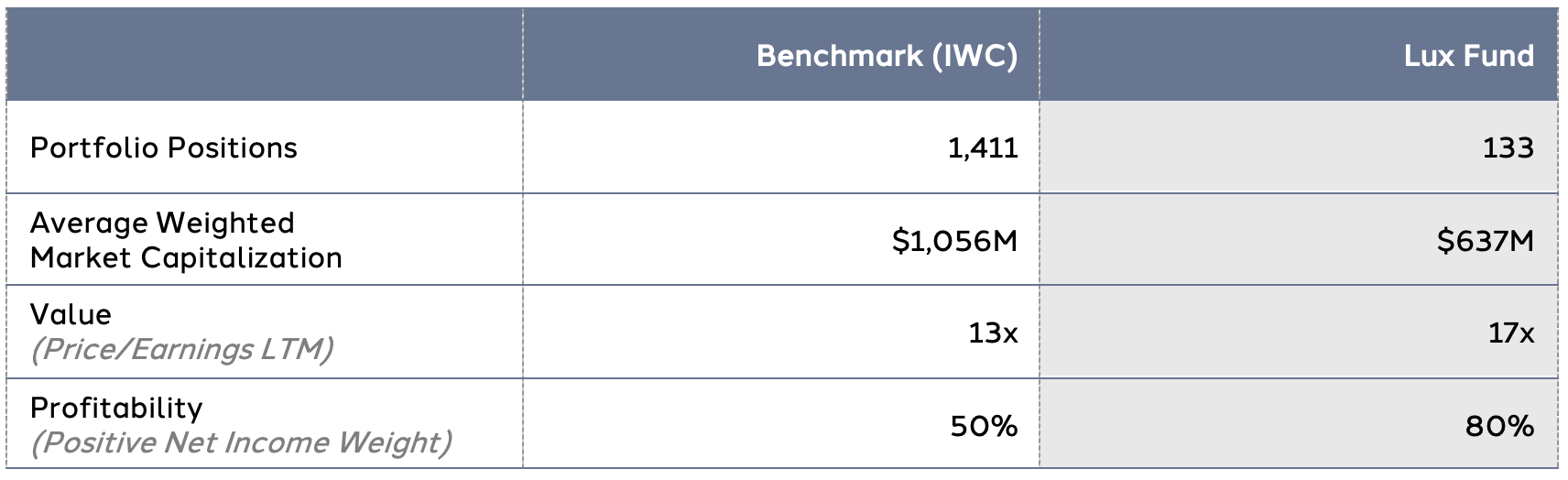

Despite market implications that the smallest public equities are inherently lower quality, our experience suggests otherwise. While the segment contains riskier businesses, it also offers the greatest potential for return. Our process, refined and proven over more than 20 years of aggregated experience managing institutional assets, combines quantitative modeling with thorough qualitative analysis to identify a diversified portfolio of durable, high-quality companies.

We intentionally avoid the riskiest companies, targeting investment in businesses we believe have sustainable growth opportunities, robust profitability profiles, attractive valuations and strong investor sentiment.

Our research indicates these companies outperform their counterparts. Over time, this approach has produced excess returns relative to small and micro cap benchmarks, demonstrating resilience across market cycles.

Throughout our careers, we have managed funds across all market capitalizations, yet our highest conviction lies in smaller companies—where inefficiencies and mispricings are most pronounced. Because large institutional investors often overlook this space, the micro cap market tends to be dominated by less sophisticated participants. For our investors, Lux Fund fills this gap, complementing their traditional asset allocations with exposure to an area of the market poised for meaningful alpha generation.

Lux Fund complements a diversified portfolio by providing rare exposure to the market’s smallest and least accessible companies.

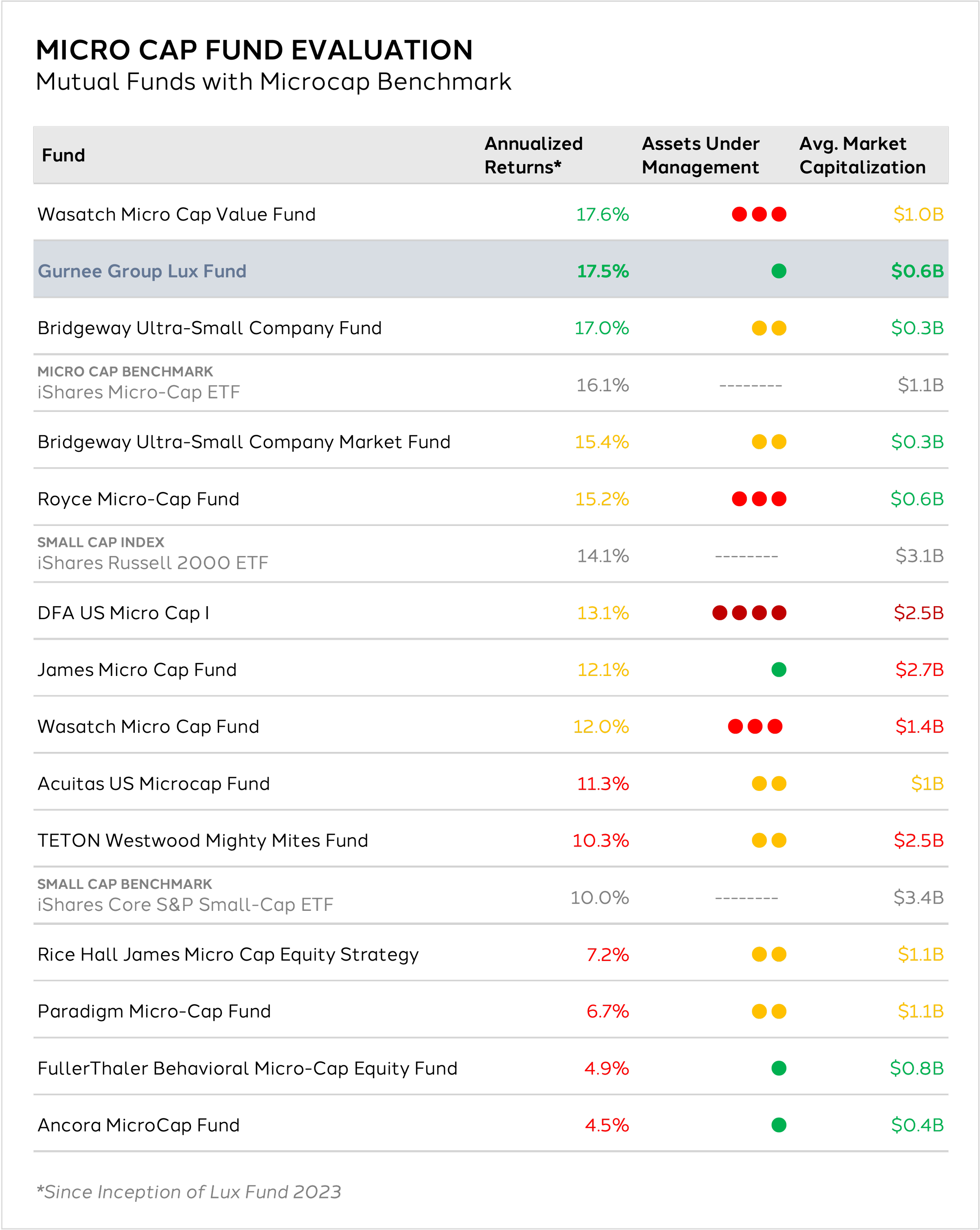

Among actively managed small and micro cap strategies, Lux Fund’s results since inception reflect clear leadership. In addition to delivering strong performance, we continually evaluate the investor experience and the operational quality of our business to ensure we uphold the highest professional standards for the institutions and families we serve. Your feedback remains vital to our ongoing improvement, and we welcome your thoughts.

We express our deepest gratitude to you and your family as we finish the year. Thank you for the opportunity to serve you.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

We continue to see quality assets within the space trading at significant discounts and expect acquisitions to be a tailwind to Lux Fund’s strategy going forward.

-

Position Changes

Our investment process emphasizes investing in profitable businesses at valuations that permit future appreciation, which we believe will result in long lasting success for our investors.

-

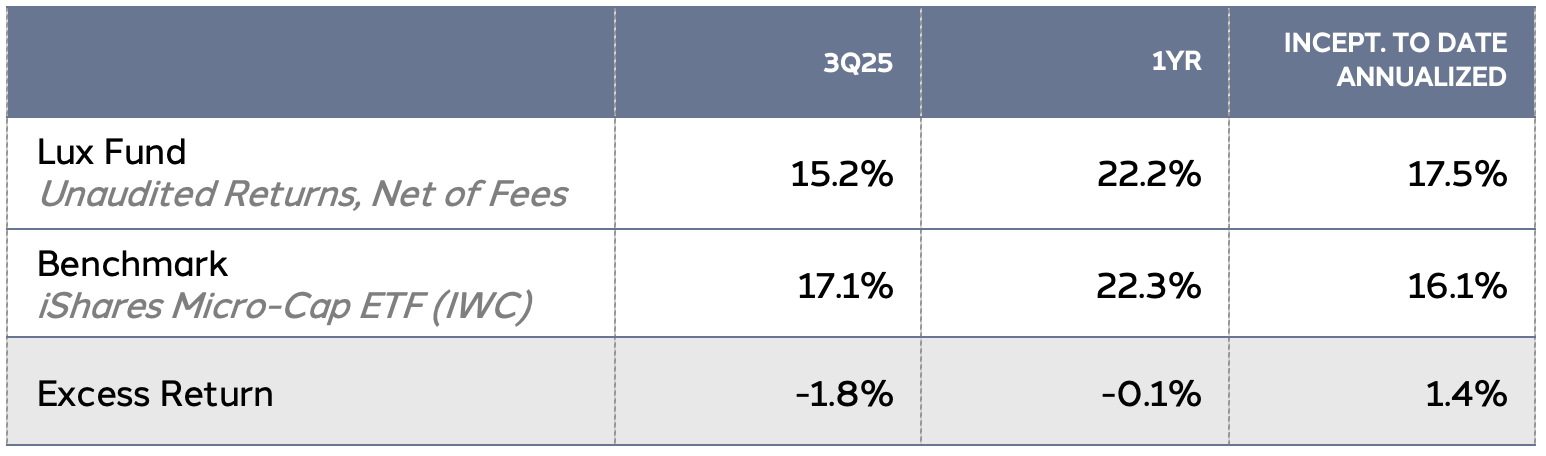

Performance Summary

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

Micro cap stocks trade at a discount to large caps, reflecting misplaced skepticism toward the smallest public companies. In contrast, many of these businesses are not inferior but mispriced—only to be acquired later at substantial premiums.

HISTORICAL ACQUISITION PREMIUM OF SMALL CAPS

Historically, the acquisition of small companies by large companies has contributed to the higher relative returns in small and micro cap equity investments versus their larger counterparts. A report published in the March 2024 issue of Journal of Financial and Quantitative Analysis analyzed the impact of acquisition activity to the small cap public equity asset class.

In summary, investments in small and micro cap companies enjoy greater benefits from acquisition premiums relative to large cap companies.

Further, Lux Fund’s investment process to date has identified more than its fair share of acquisition opportunities: year to date in 2025, nine of Lux Fund’s holdings received acquisition offers, equating to approximately 10% of the portfolio, with average acquisition premium of 50%. Over the same period only 3.5% of the broader micro cap equity market received acquisition offers.

OUR OUT-OF-CONSENSUS CASE AGAINST ADVERSE SELECTION

We continue to see quality assets within the space trading at significant discounts and expect acquisitions to be a tailwind to Lux Fund’s strategy going forward. Here are some of the quality assets we’re currently invested in that we see as potential acquisition targets:

-

AngioDynamics

AngioDynamics produces a variety of medical devices. We believe the company’s product offering in the interventional cardiology space represents potentially best in class therapy which will enable continued share gains from larger competitors. We believe the company’s current attractive valuation creates an opportunity for an accretive acquisition and market share consolidation by a large medical device competitor.

-

Mitek Systems

Mitek Systems provides software supporting 90%+ of mobile check deposits in the United States. Formerly the subject of acquisition rumors in 2018, we believe the company is fundamental stronger today despite trading for a similar valuation. We are encouraged by the recent appointment of CEO Ed West, who oversaw the sale of Cardtronics to NCR in 2021. Prior to Cardtronics, West was CFO of Delta Airlines. We see Mitek as a strong acquisition candidate for a financial technology company or a private equity firm given its strategic position in banking technology and associated strong cash flow generation.

-

National Research Corporation

National Research Corporation provides critical healthcare services industry data. The business currently trades at a significant discount to the precedent transactions of a key competitor. The company’s management team has significant ownership in the business and we believe will maximize shareholder value. On a related note, we are encouraged by the appointment of CEO Trent Green, who will draw on experience as the former leader of Amazon’s healthcare business, One Medical.

-

UroGen Pharma

UroGen Pharma provides oncology therapies in high unmet need treatment settings. We believe the company’s recent Zusduri approval, combined with a healthy revenue base from Jelmyto, collectively present a compelling acquisition target for a large pharma company.

Recent acquisitions at premium valuations affirm the quality of public micro-cap equities, even amid persistent discounts. Lux Fund remains uniquely positioned to benefit from this enduring trend.

Position Changes

-

New positions are initiated in the fund when they are attractive per LuxβetaTM (quantitative review) and validated through LuxαlphaTM (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

908 DEVICES

BANDWIDTH

CORE LABORATORIES

DELCATH SYSTEMS

FARMERS NATIONAL BANC

JAKKS PACIFIC

KARAT PACKAGING

MAGNERA

METROPOLITAN BANK HOLDING

NUVATION BIO

STONERIDGE

TRUSTCO BANK

TUCOWS

UNITED FIRE GROUP

WEAVE COMMUNICATIONS

-

Positions are sold from the fund when their LuxβetaTM profile deteriorates, the company develops significant off model, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

FRANKLIN COVEY

INTERNATIONAL MONEY EXPRESS (received acquisition offer)

NERDWALLET

OLO (received acquisition offer)

OMNIAB

POTBELLY (received acquisition offer)

TITAN INTERNATIONAL

SOLARIS ENERGY INFRASTRUCTURE

SUPERIOR GROUP OF COMPANIES

VIRTRA

Y-MABS THERAPEUTICS (received acquisition offer)

Performance Summary

Returns

Top Contributors

Top Detractors

Portfolio Characteristics

Top 10 Holdings

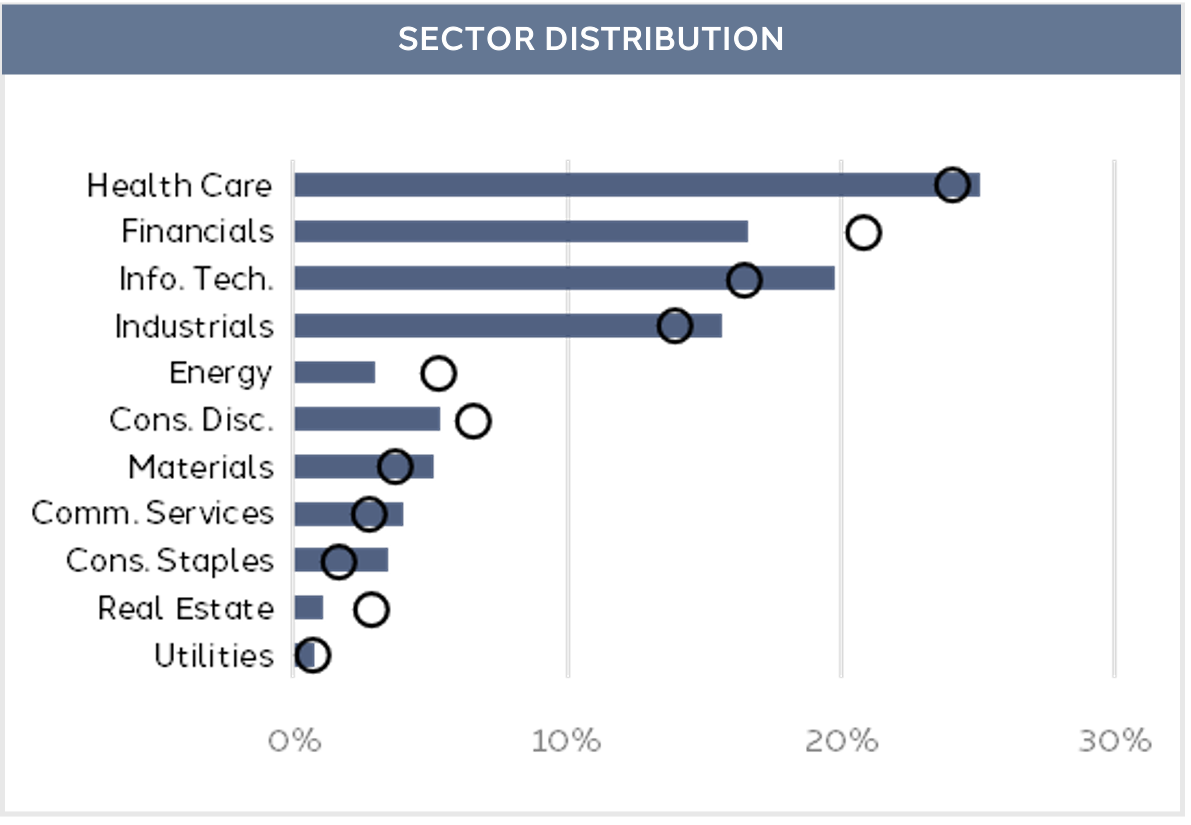

Sector Distribution

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.