FOURTH QUARTER 2025

Letter to Investors

January 15, 2026

My fellow investors,

We formed Gurnee Group with a simple objective:

To provide access to uniquely curated investments that meaningfully enhance traditional portfolios.

From the outset, our focus has been on identifying opportunities that combine strong long-term return potential with true diversification benefits.

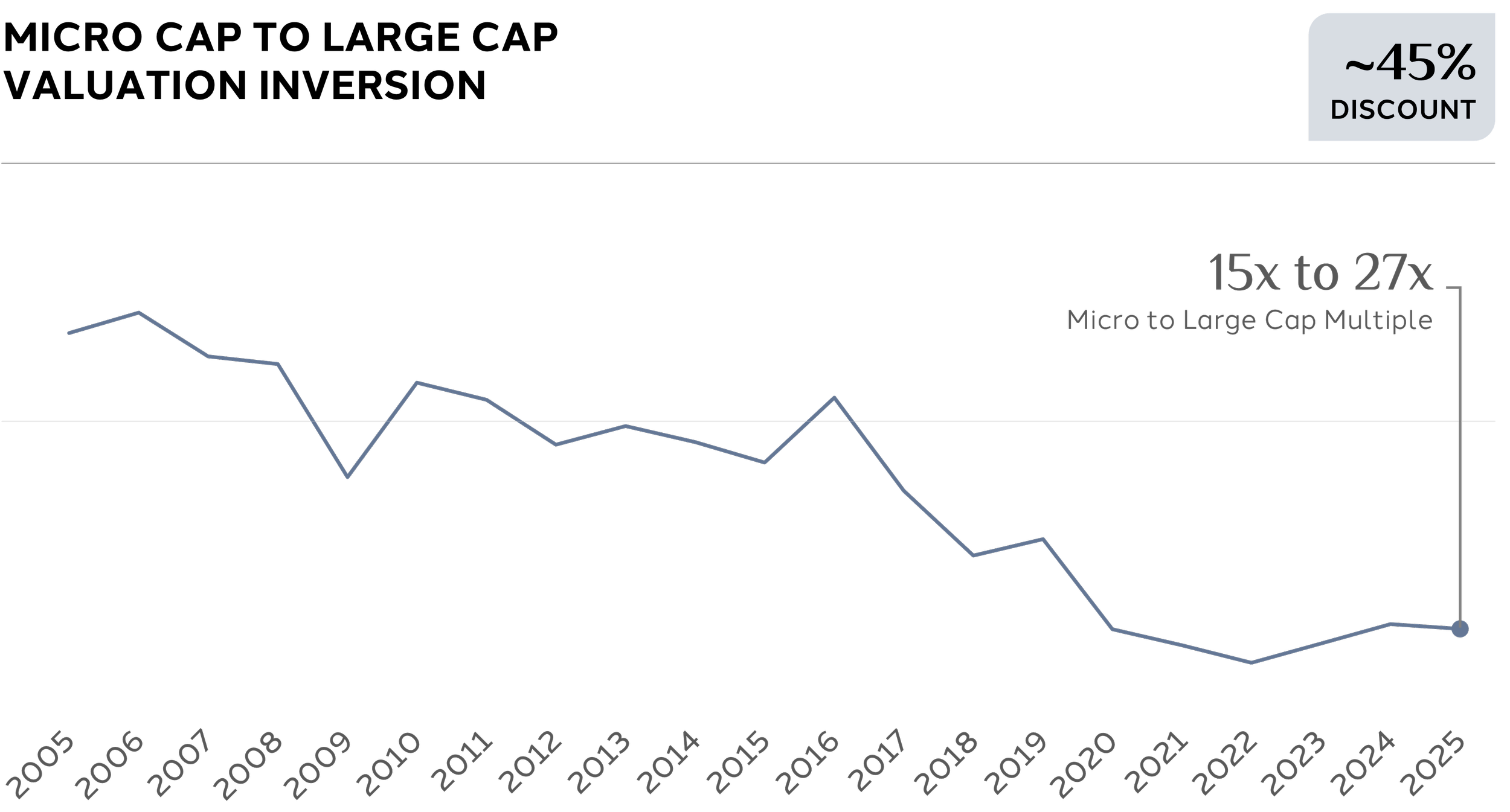

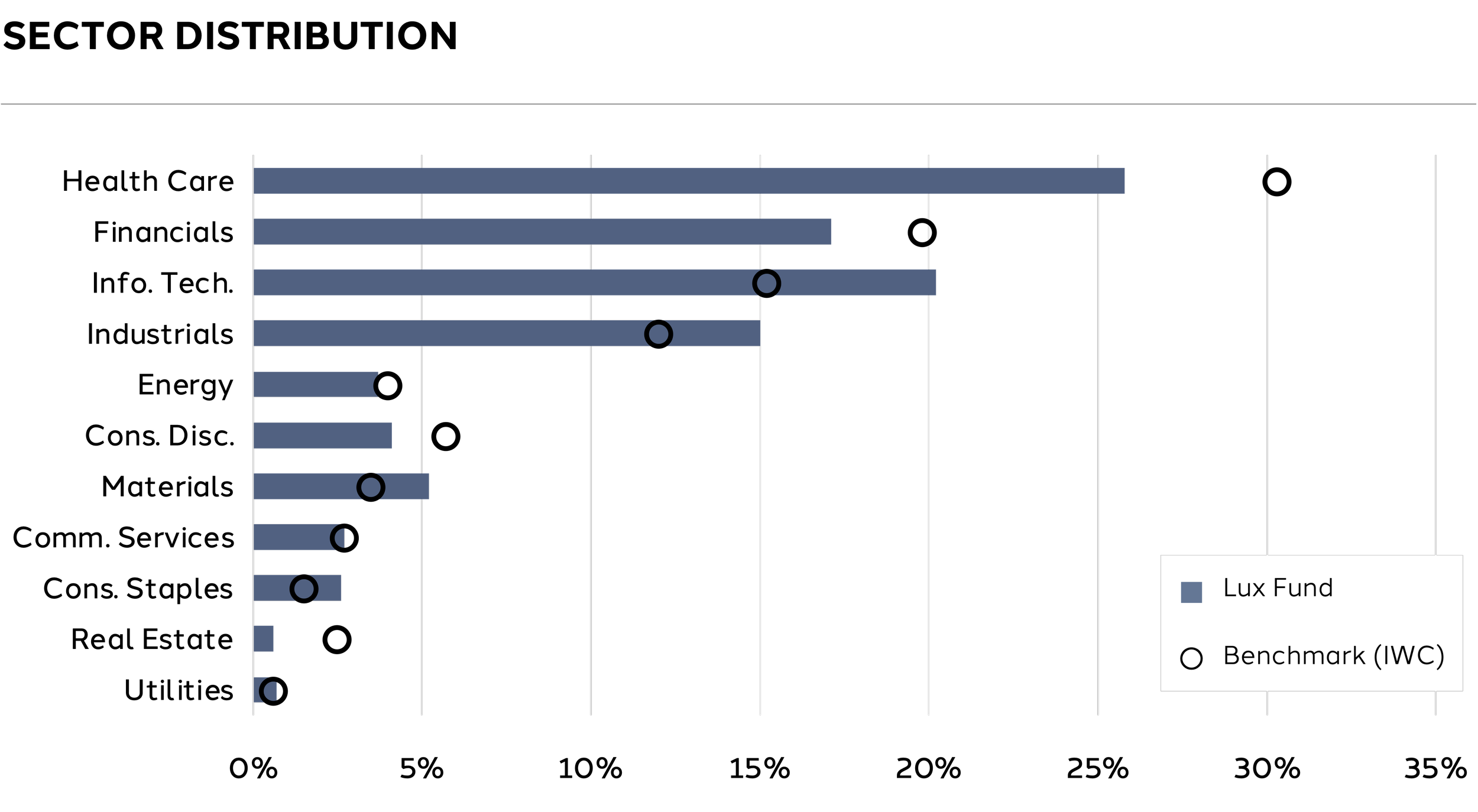

Our initial strategy, Lux Fund, is designed to provide access to high-quality companies operating in the smallest segment of the public equity markets. By investing in this overlooked corner of the market, we aim to deliver (1) attractive long-term returns and (2) diversification within your total investable portfolio. The strategy also seeks to capitalize on a current anomaly in public markets—the unusually wide valuation spread between large public companies and small public companies, where small companies are being discounted.

As shown below, these small public companies have historically generated the strongest returns over time. Yet, globally diversified portfolios typically have little to no exposure to them.

Today, this opportunity is further amplified by valuation: the smallest public companies currently trade at approximately a 45% discount to their large-cap counterparts.

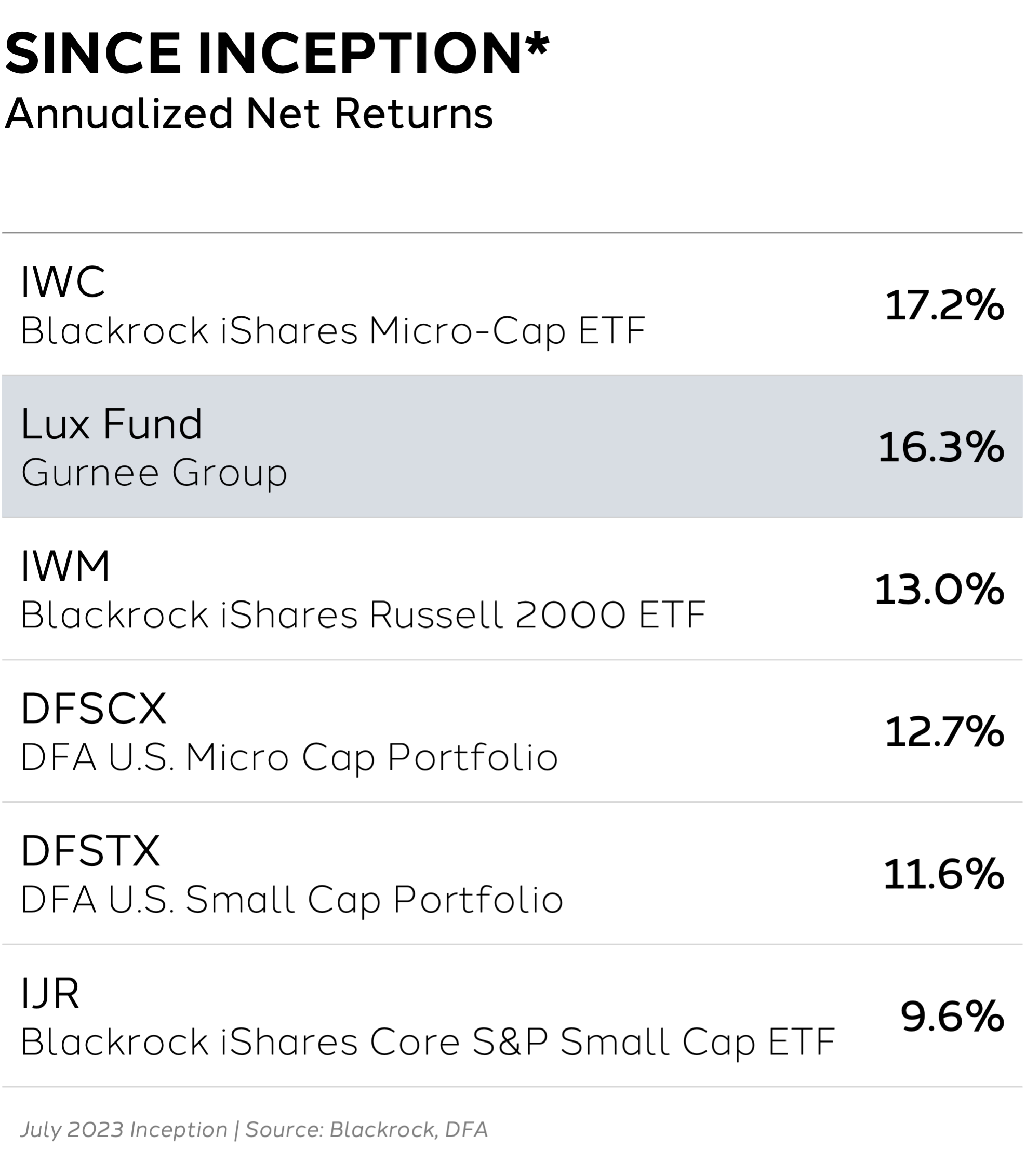

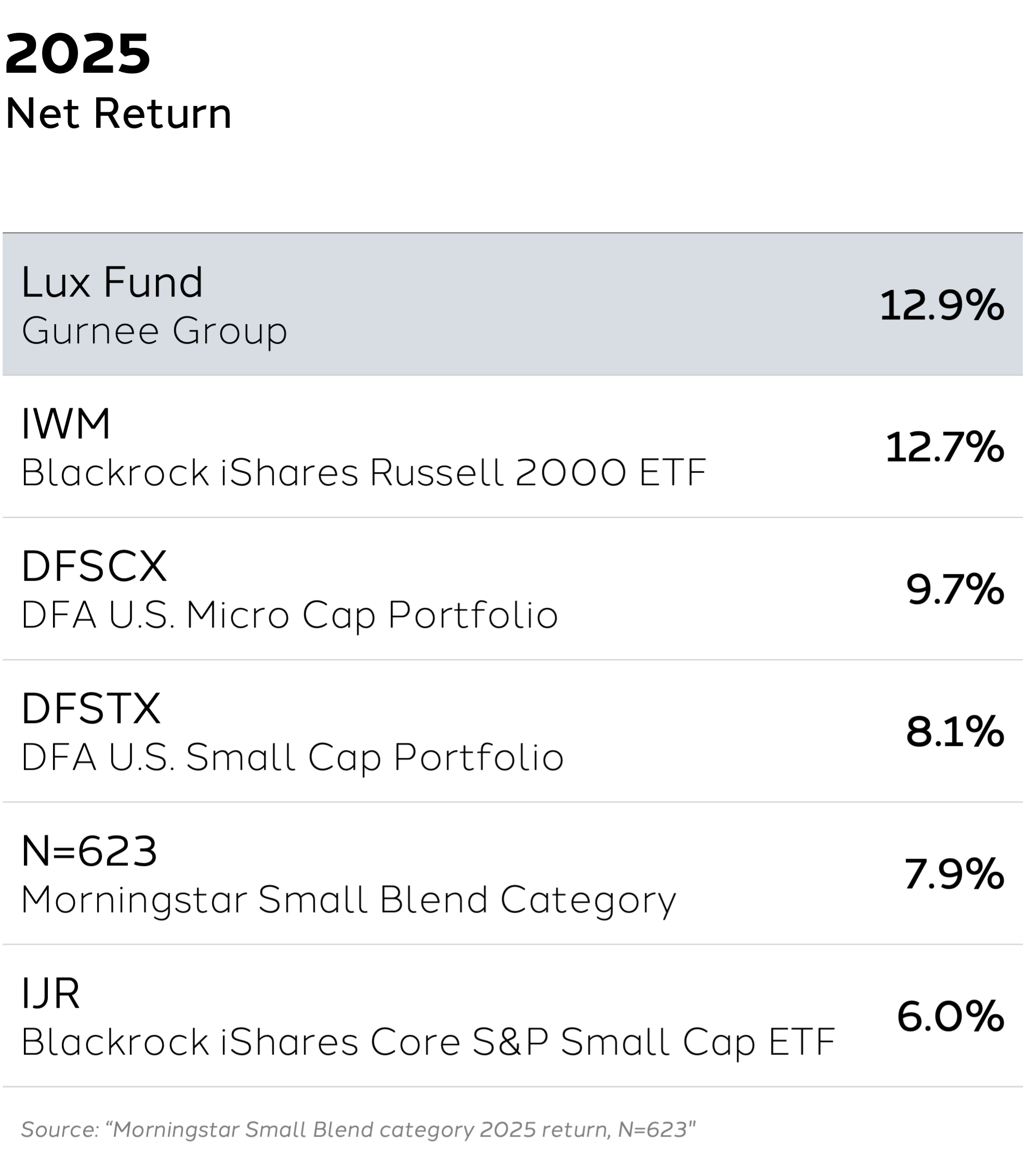

Since inception in mid-2023, Lux Fund has delivered strong relative net returns compared to other small-cap investment strategies. During 2025, the fund performed in the top quintile of managers in Morningstar’s Small Blend category—623 funds in total—and significantly outperformed widely followed small-cap benchmarks.

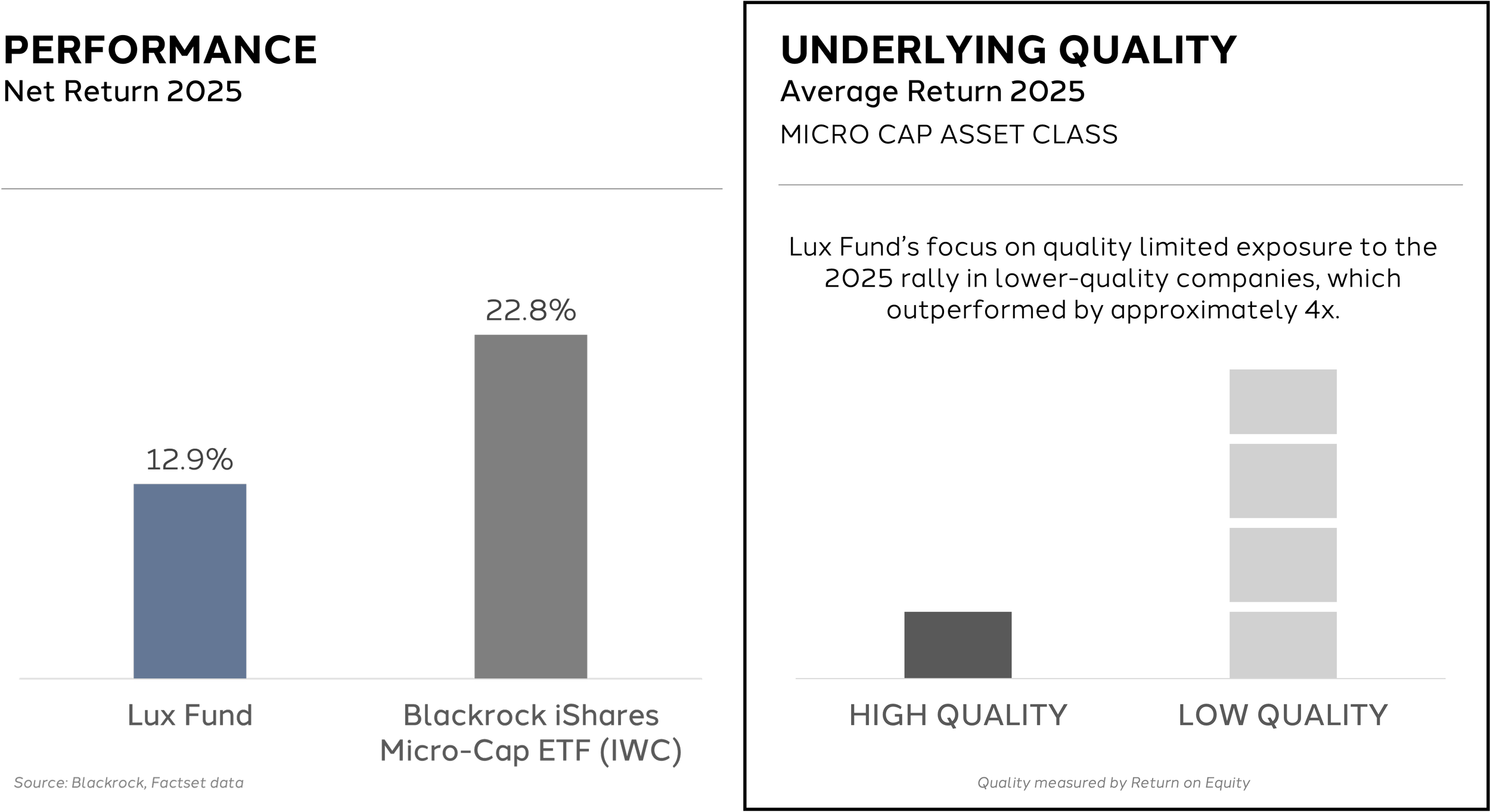

In 2025, Lux Fund underperformed the micro-cap asset class. This was driven by weak relative performance among the higher-quality companies emphasized in our strategy, alongside strong returns from lower-quality assets that are underrepresented in our portfolio.

Academic research indicates that high quality—captured by measures such as return on equity—outperforms low quality over the long run. Accordingly, we entered 2025 overweight quality and remain similarly positioned as we enter 2026.

We continue to believe that a diversified portfolio of quality assets trading at discounted valuations offers a more compelling long-term opportunity than a concentrated portfolio of highly valued assets.

Looking ahead, we believe we are entering 2026 with an unusually attractive opportunity set. We provide additional detail in our Portfolio Outlook, but in summary:

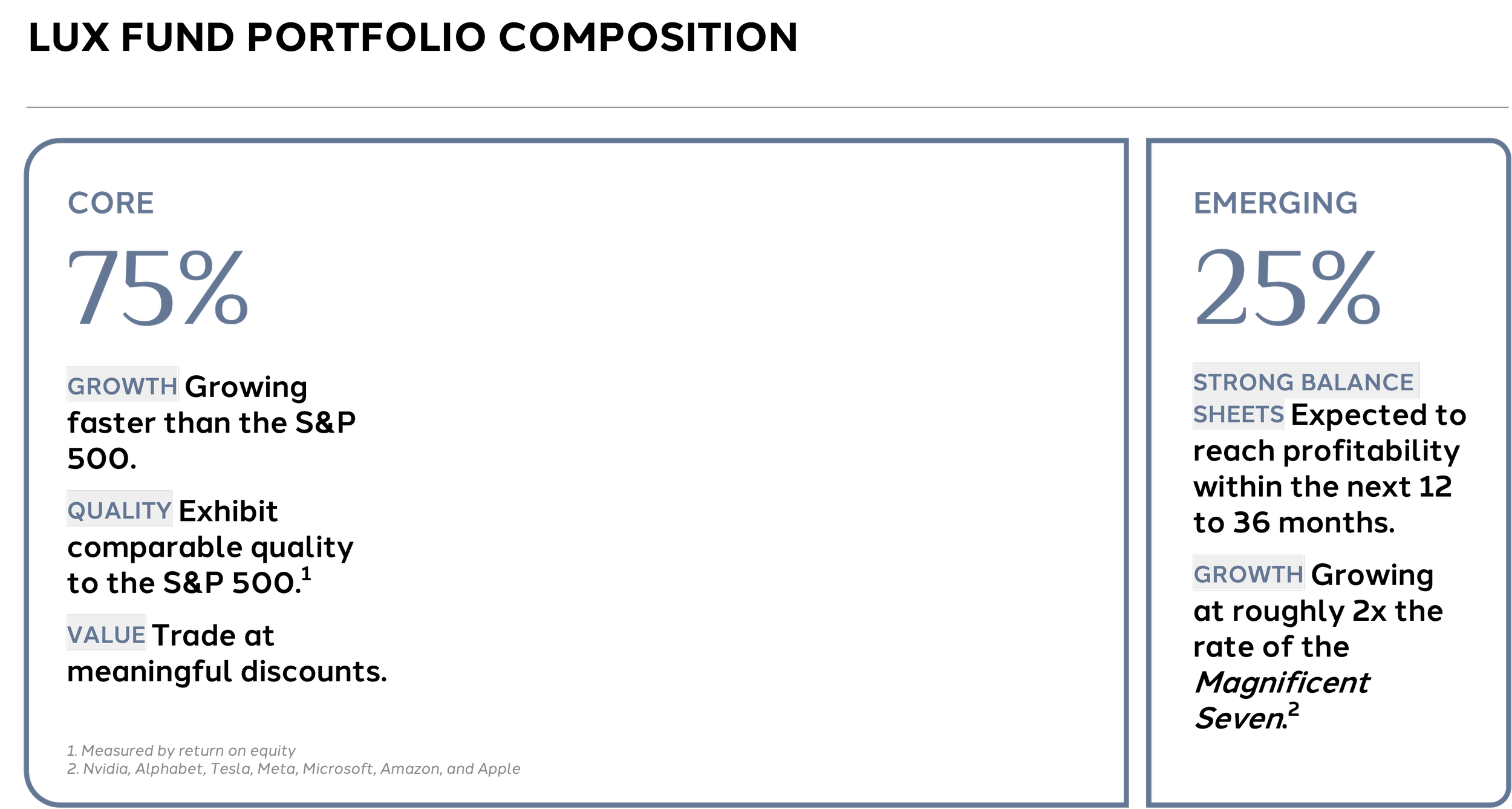

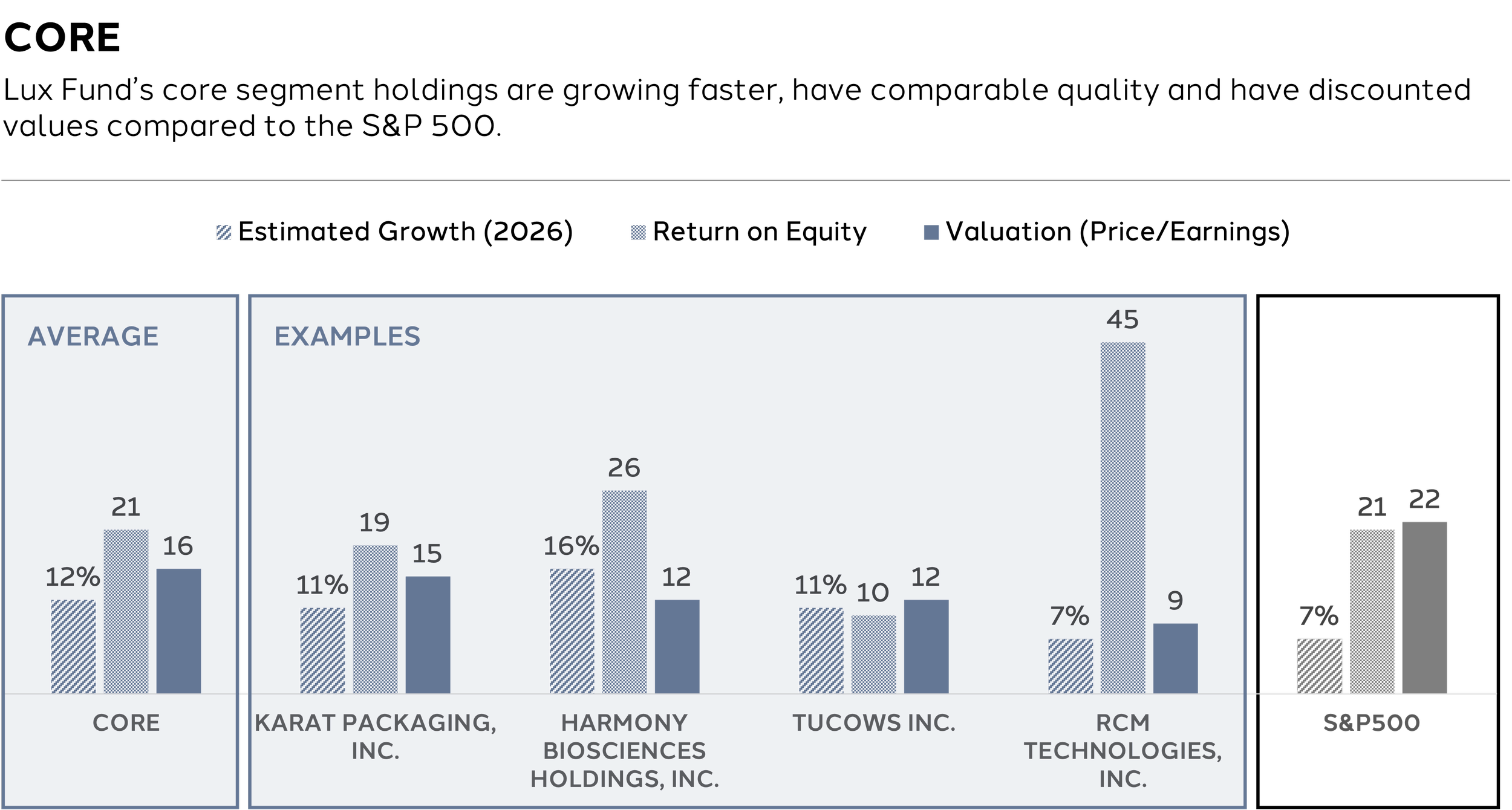

CORE The core 75% of the portfolio is comprised of companies that, in aggregate, are growing faster than the S&P 500, exhibit comparable quality as measured by return on equity and trade at meaningful discounts.

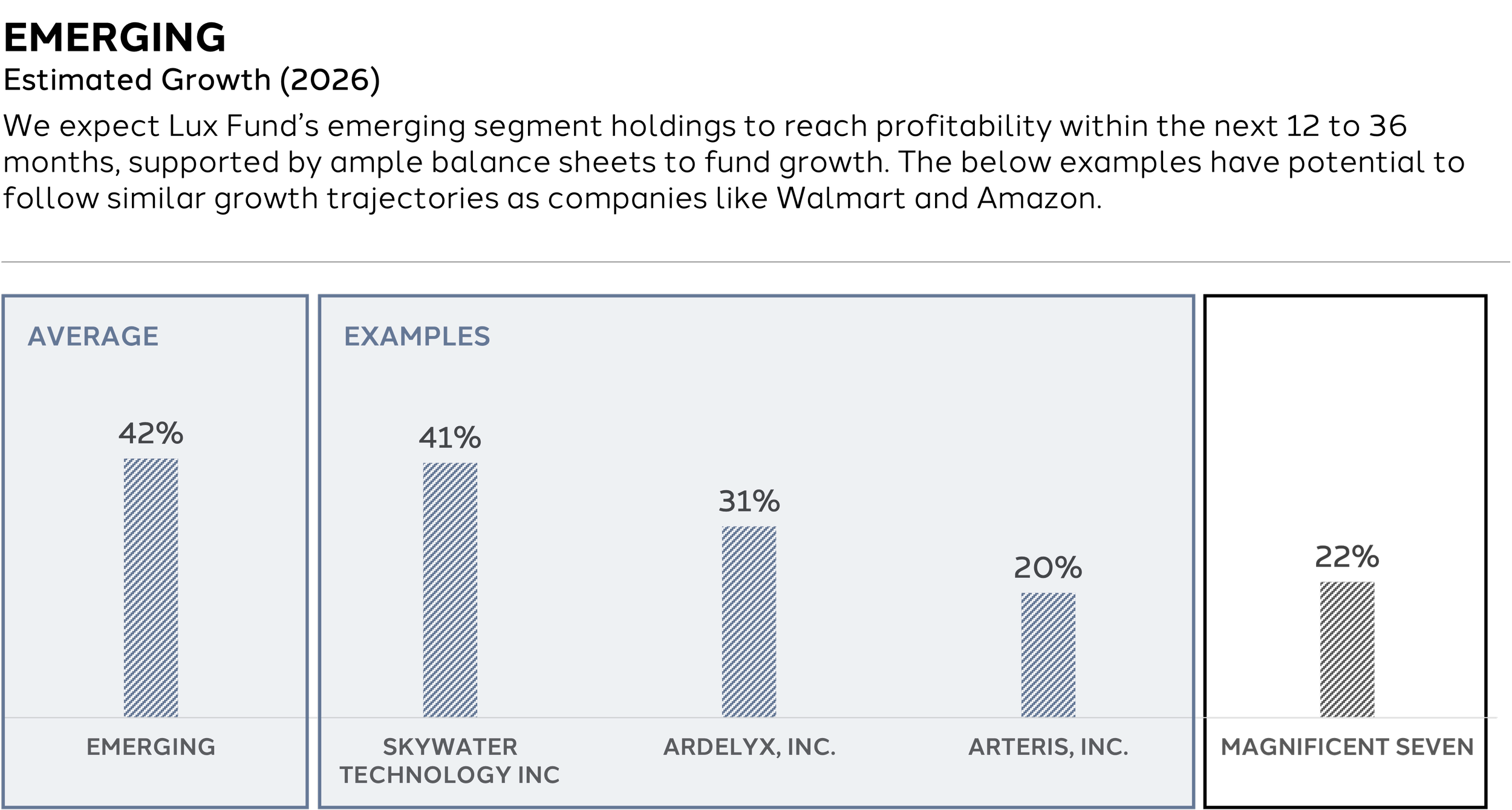

EMERGING The remaining 25% of the portfolio is invested in companies we expect to reach profitability within the next 12 to 36 months, supported by ample balance sheets to fund growth. Collectively, these businesses are growing at roughly twice the rate of the Magnificent Seven—Nvidia, Alphabet, Tesla, Meta, Microsoft, Amazon, and Apple.

We will reach our third anniversary of operations in June of this year. It is a privilege to have earned your trust, and we are deeply grateful when our investors introduce Gurnee Group to their peers. Thank you for your continued partnership and participation in Lux Fund.

Sincerely,

J.P. Gurnee, CFA

Portfolio Manager

jp@gurneegroup.com | 989.513.0082

-

Portfolio Outlook

We continue to believe that a diversified portfolio of quality assets trading at discounted valuations offers a more compelling long-term opportunity than a concentrated portfolio of highly valued assets.

-

Position Changes

Our investment process emphasizes investing in profitable businesses at valuations that permit future appreciation, which we believe will result in long lasting success for our investors.

-

Performance Summary

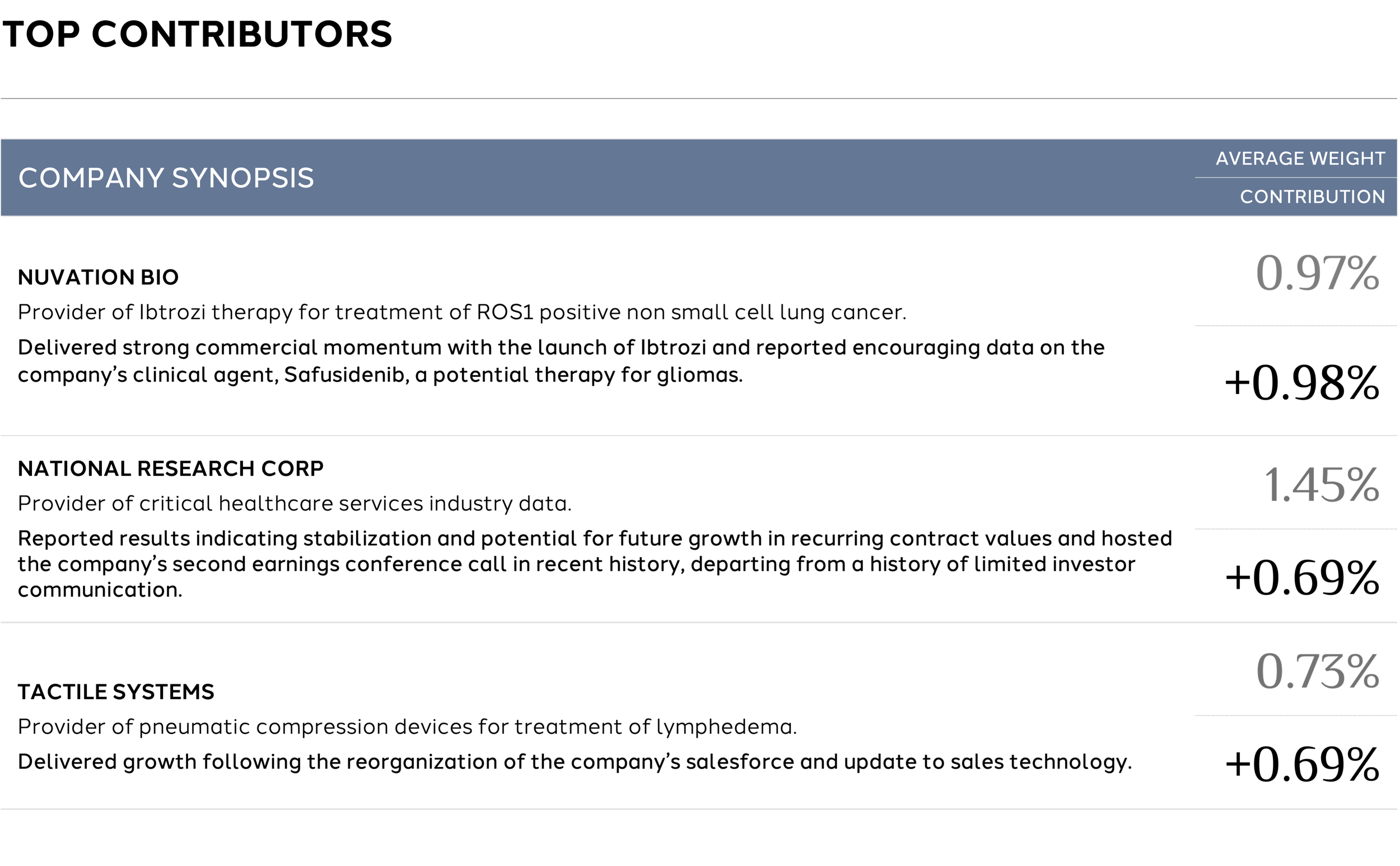

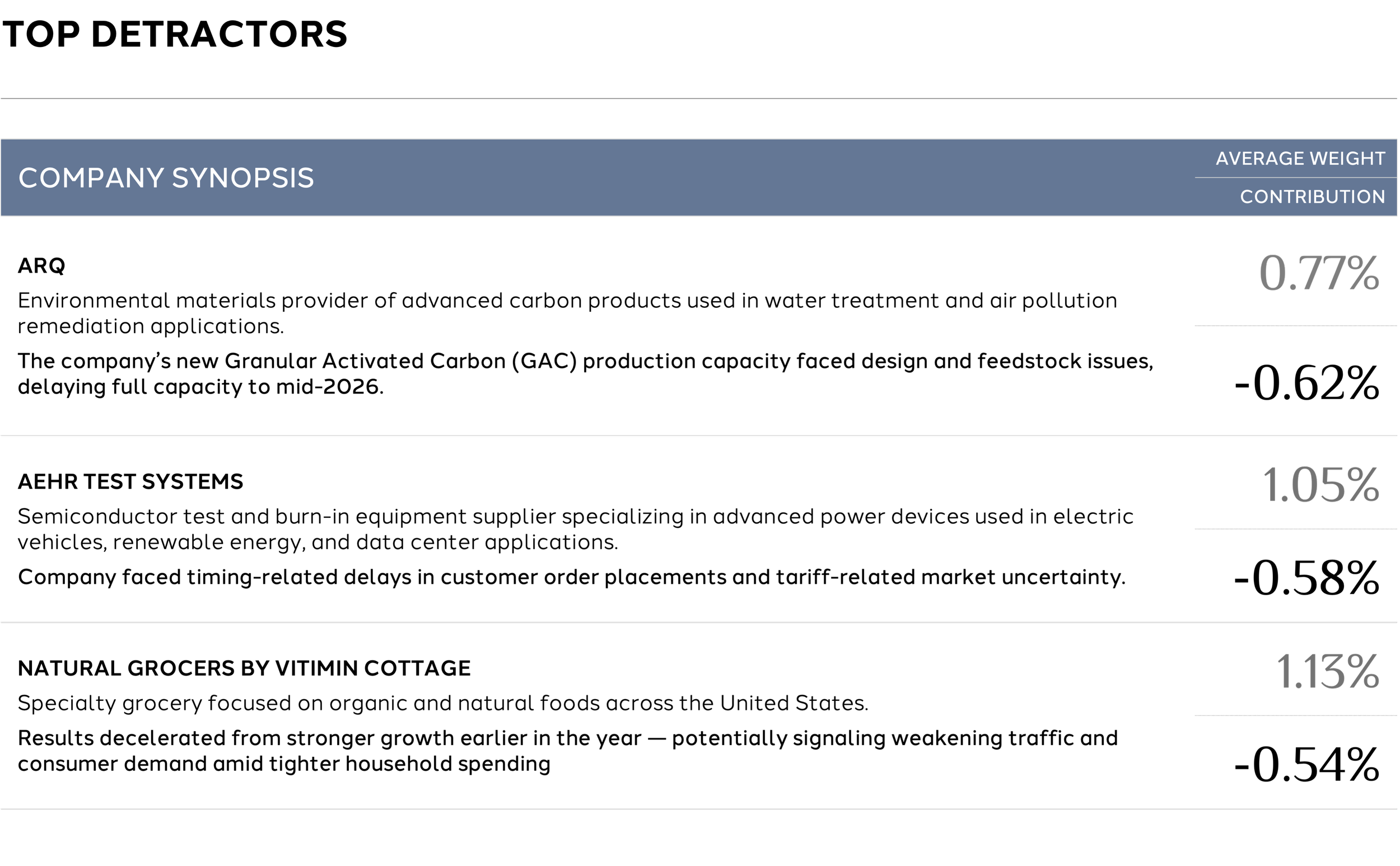

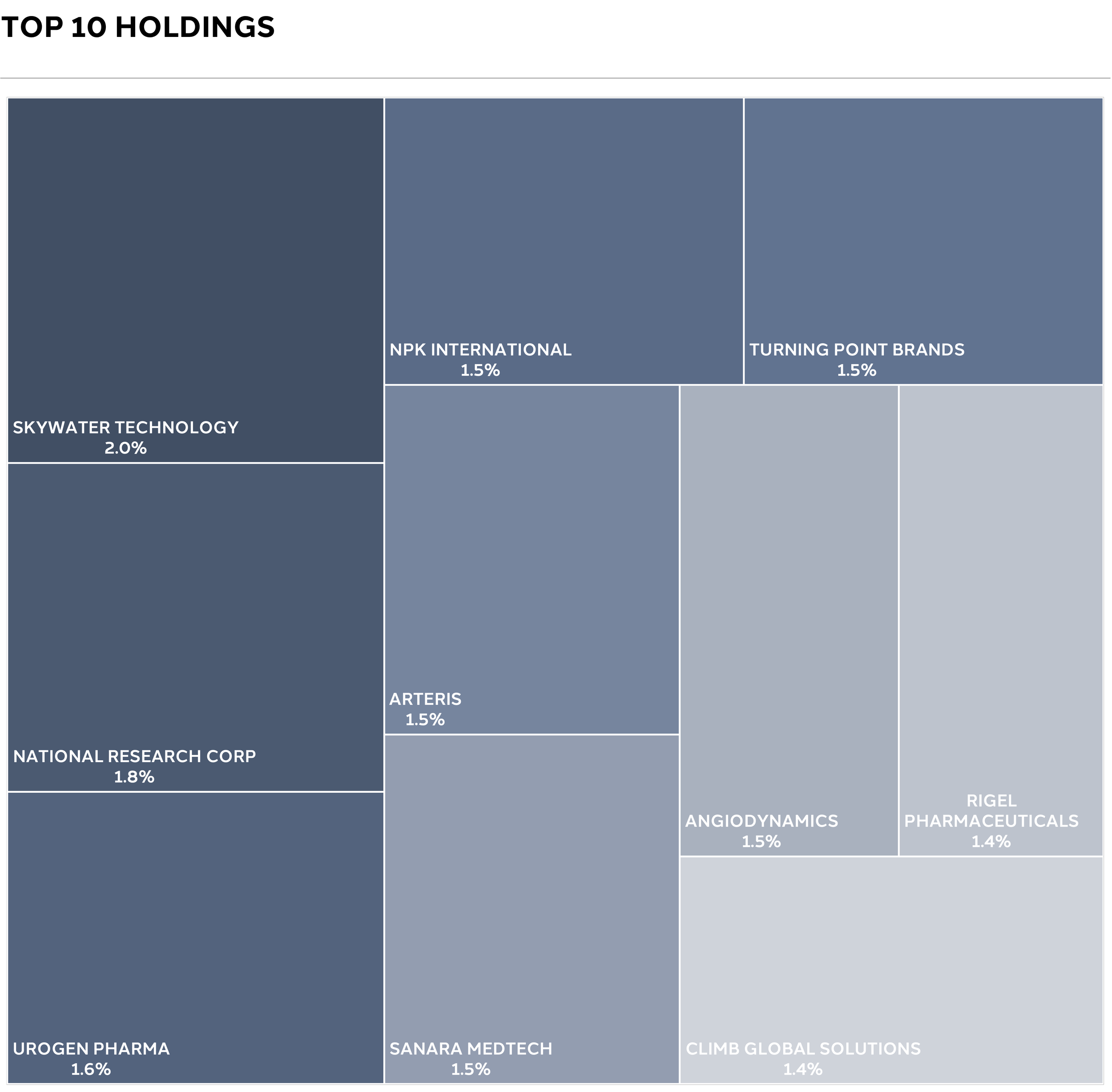

View quarterly results including returns, top contributors and detractors, and portfolio characteristics.

Portfolio Outlook

We enter 2026 with an unusually compelling opportunity set—one that allows investors to own small public companies with stronger fundamentals than the S&P 500 and faster growth than the Magnificent Seven.

To capitalize on this environment, we have constructed an all-weather portfolio consisting of approximately 75% core holdings and 25% emerging growth companies.

The core portfolio is comprised of profitable, high-quality businesses that are collectively growing faster than the S&P 500 while trading at meaningful discounts. These companies combine growth and return on equity with valuations that remain compressed due to limited institutional and passive ownership.

The remaining 25% of the portfolio is invested in emerging growth companies we expect to reach profitability within 12 to 36 months. These businesses have ample balance sheets to fund their growth and, in aggregate, are growing at roughly twice the rate of the Magnificent Seven. We have underwritten each to profitability and believe several have the potential to become future mid and large cap leaders.

Together, this structure positions the portfolio to be resilient across market environments while preserving significant upside as valuations normalize.

Position Changes

-

New positions are initiated in the fund when they are attractive per LuxβetaTM (quantitative review) and validated through LuxαlphaTM (qualitative analysis). The fund initiated new positions in the following companies during the quarter:

BEACHBODY

COGNYTE SOFTWARE

CREXENDO

ESPEY MFG & ELECTRONICS

FIRST BUSINESS FINANCIAL SERVICES

GLOBAL INDUSTRIAL COMPANY

GRID DYNAMICS

HARMONY BIOSCIENCES

KEWANEE SCIENTIFC

NCS MULTISTAGE

ONESPAN

PROTALIX BIOTHERAPEUTICS

SILVACO GROUP

-

Positions are sold from the fund when their LuxβetaTM profile deteriorates, the company develops significant off model, appreciates out of the micro cap asset class, or the company is acquired. The fund sold positions in the following companies during the quarter:

ALDEYRA THERAPEUTICS

AVITA MEDICAL

DXP ENTERPRISES

FUTUREFUEL

HEALTHSTREAM

J JILL

LAKELAND INDUSTRIES

NATURES SUNSHINE

PLYMOUTH INDUSTRIAL REIT (received acquisition offer)

RXSIGHT

TACTILE SYSTEMS TECHNOLOGY

ZOMEDICA

Performance Summary

Let’s keep in touch.

ⁱUnaudited return net of fees.

Gurnee Group, LLC (the “General Partner”) is not registered as an investment adviser with the Securities and Exchange Commission. However, the General Partner is registered as an investment adviser with the Department of Commerce of the State of Ohio. The limited partnership interests (the “Interests”) in Gurnee Group Lux Fund, LP (the “Fund”), are offered under a separate private offering memorandum (the “Offering Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act"), nor any state's securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time.

This presentation is being furnished to you on a CONFIDENTIAL basis to provide preliminary summary information regarding an investment in the Fund managed by the General Partner and may not be used for any other purpose. Any reproduction or distribution of this presentation or accompanying materials, if any, in whole or in part, or the divulgence of any of its contents is prohibited. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. It is meant to be read in conjunction with the Offering Memorandum prepared in connection herewith, and does not constitute an offer to sell, or a solicitation of an offer to buy, by anyone in any jurisdiction in which such an offer or solicitation is not authorized or in which the making of such an offer or solicitation would be unlawful. The information contained herein does not purport to contain all of the information that may be required to evaluate an investment in the Fund. The information herein is qualified in its entirety by reference to the Offering Memorandum, including, without limitation, the risk factors therein.

A prospective investor should only commit to an investment in the Fund if such prospective investor understands the nature of the investment and can bear the economic risk of such investment. THE FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. The Fund may lack diversification, thereby increasing the risk of loss. The Fund's performance may be volatile. There can be no guarantee that the Fund's investment objectives will be achieved, and the investment results may vary substantially from year to year or even from month to month. AS A RESULT, AN INVESTOR COULD LOSE ALL OR A SUBSTANTIAL AMOUNT OF ITS INVESTMENT. In addition, the Fund's fees and expenses may offset its profits. There are restrictions on withdrawing and transferring interests from the Fund. In making an investment decision, you must rely on your own examination of the Fund and the terms of the Offering Memorandum and such other information provided by the General Partner to you and your tax, legal, accounting or other advisors. The information herein is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. You should consult your tax, legal, accounting or other advisors about the matters discussed herein. The Fund's ability to achieve its investment objectives may be affected by a variety of risks not discussed herein. Please refer to the Offering Memorandum for additional information regarding risks and conflicts of interest.

No representations or warranties of any kind are made or intended, and none should be inferred, with respect to the economic return or the tax consequences from an investment in the Fund. No assurance can be given that existing laws will not be changed or interpreted adversely. Prospective investors are not to construe this presentation as legal or tax advice. Each investor should consult his or its own counsel and accountant for advice concerning the various legal, tax, ERISA and economic matters concerning his or its investment.

No person other than the General Partner, and its Principal, has been authorized to make representations, or give any information, with respect to these membership interests, except the information contained herein, and any information or representation not expressly contained herein or otherwise supplied by the Principal in writing must not be relied upon as having been authorized by the General Partner or any of its members. Any further distribution or reproduction of these materials, in whole or in part, or the divulgence of any of its contents, is prohibited.

An investment in the Fund has not been approved by any U.S. federal or state securities commission or any other governmental or regulatory authority. Furthermore, the foregoing authorities have not passed upon the accuracy, or determined the adequacy, of this document, the Offering Memorandum or limited partnership agreement associated with the Fund. Any representation to the contrary is unlawful.

Certain information contained in this document constitutes “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The General Partner is the source for all graphs and charts, unless otherwise noted.

This document may present past performance data regarding prior/other investments, funds, and/or trading accounts managed by the General Partner and/or the Principal. This is presented solely for explanatory purposes. The Fund may face risks not previously experienced or anticipated by the General Partner and/or Principal, and therefore, prospective investors should evaluate the Fund on its own merits. Furthermore, there is no guarantee the General Partner and/or Principal will be able to replicate the mandate, strategy, portfolio construction and risk management parameters reflected in their prior performance data. Market factors and unforeseen circumstances both internally and externally may result in a wide deviation from the returns reflected in the prior performance data, and there is no guarantee the General Partner and/or Principal will be able to avoid and/or remediate such internal and external factors.

Furthermore no representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Any such estimates, opinions or assumptions should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Offering Memorandum. The assumptions and facts upon which any estimates or opinions herein are based are subject to variations that may arise as future events actually occur. There is no assurance that actual events will correspond with the assumptions. Potential investors are advised to consult with their tax and business advisors concerning the validity and reasonableness of the factual, accounting and tax assumptions. Neither the General Partner nor any other person or entity makes any representations or warranty as to the future profitability of the Fund.

PAST PERFORMANCE IS NOT INDICATIVE OR A GUARANTEE OF FUTURE RESULTS.

This document may also present “sample holdings” or “case studies” of a type of asset(s) the Fund may invest in or are expected to be typical of its holdings. Such “sample holdings” are not currently holdings of the Fund and are presented solely for explanatory purposes. Prospective Investors should not assume that such “sample holdings” will actually be purchased by the Fund when determining whether to make an investment in the Fund.